During the fourth quarter of 2024, Praetorian Capital Fund LLC (the “Fund”) depreciated by 14.76% net of fees. For the full year, the Fund depreciated by 10.55% net of fees. Since inception, the Fund has compounded capital at an 41.76% annual net rate. A dollar invested at inception, would be worth approximately $8.11 net of fees, after 6 years invested in the Fund.

Given the Fund’s concentrated portfolio structure and focus on asymmetric opportunities, I anticipate that the Fund will be rather volatile from quarter to quarter. During the fourth quarter, our core portfolio positions experienced a decline, while the Event-Driven book produced a slightly positive return. For the full year, our core portfolio positions in aggregate declined, while our Event-Driven book helped to balance out the losses in the core book. As I have noted many times, the two strategies tend to offset, particularly at times when the core book does poorly, and it was heartening to see the Event-Driven book do heroic work in balancing out the losses on the core book.

|

Praetorian Capital Fund LLC |

||

|

Gross Return |

Net Return |

|

|

Q1 2024 |

11.90% |

9.25% |

|

Q2 2024 |

-1.76% |

-1.69% |

|

Q3 2024 |

-2.51% |

-2.29% |

|

Q4 2024 |

-15.48% |

-14.76% |

|

2024 |

-9.41% |

-10.55% |

|

2023 |

34.70% |

26.45% |

|

2022 |

16.38% |

11.95% |

|

2021 |

181.80% |

142.87% |

|

2020 |

161.87% |

129.49% |

|

2019 |

18.71% |

14.97% |

|

Since Inception (1/1/19) |

1143.98% |

711.43% |

| Net return varies from gross return as it accounts for management fees and incentive allocations. Please see the additional disclaimers on the final page of this document. |

As I have mentioned on many occasions, my expectations for this Fund’s performance are bifurcated, and I anticipate that we’ll have many standard years where the Fund’s performance ranges from down teens to up twenties percent on a net basis. With my focus on deep value situations, along with expected gains on the Event-Driven book, our return profile should skew to the positive side during a standard year. Interspersed with these standard years, will be years where I expect our core positions to dramatically outperform as they catch strong tailwinds, and we are up triple digits on a net basis. To date, we’ve had four of these rather standard years (2019, 2022, 2023, 2024), and two years with dramatic outperformance (2020 and 2021). While I would hope to never have a down year, down years like we have just experienced are well within my range of expectations. In this particular case, the current drawdown, calculated based on end of month cumulative performance, is approaching 31.36% on a gross basis (27.62% net), which is at the extreme end of my range of expectations for a drawdown, excluding a broad market crisis.

While this Fund has no official benchmark, I recognize that many investors tend to look at large-cap equity indexes as an unofficial benchmark. Given the strong positive returns from those indexes during 2024, our returns this year are even more disheartening. I want you to know that this Fund comprises a substantial portion of my net worth, and I am beyond frustrated with our returns—particularly as our Event-Driven book has done quite well in hiding the scope of our true mark-to-market losses in the core book. Additionally, unlike other years in my career when I lost money and could point to very clear mistakes that I had made, this year I really feel like I haven’t made any sizable unforced errors on our core portfolio positions. In fact, we’ve harvested many highly-profitable winners from the core book over the course of the year. Rather, our negative performance during the year can be tied to three baskets of exposure. For those of you who want the gory details, during the year, we experienced losses of $28.3 million in offshore services, losses of $12.2 million in St. Joe (JOE – USA) and losses of $16.3 million in physical uranium, offset by gains of $25.7 million in everything else.

I’ve touched on these three baskets over the past two quarters, but given the downward trend in them during the fourth quarter, and the extreme level of undervaluation I perceive today, I want to focus this letter on why offshore services have become such a large weighting in this Fund, and to a lesser extent, how silly the mispricing at JOE has become, despite what I see as dramatic growth in NAV. Finally, we used our uranium position as a source of proceeds to fund our additions to the offshore book, which served to crystallize some substantial gains from our initial uranium purchases, though our average selling prices were below where these entities ended the year in 2023. I remain quite bullish on uranium, and at year end, it represented approximately 6.2% of our capital. However, I like to be a pragmatist, and when two baskets diverge in value, I want to buy the much cheaper one—especially if the tailwinds in offshore services appear so much stronger.

Offshore Services (33.6% of our capital at year-end)

In 2010, at the dawning of the age of shale, offshore oil production accounted for approximately 31% of global oil supply. As shale has encroached on offshore, that number has declined to only 27% of total oil production in 2024. As you can imagine, this has led to a bear market in offshore services equipment that has lasted for more than a decade and bankrupted almost all players in the sector. This offshore equipment (Drillships, Semi-Subs, Jackups, PSVs, AHTS, and other associated pieces of highly engineered steel) is what we own through positions in Valaris (VAL – USA), Tidewater (TDW -USA) and Noble (NE – USA), as I believe that the decade-long bear market has now ended, and that the call on this equipment will lead to excess profits for these companies for many years into the future.

Why did shale encroach so effectively against offshore and steal so much market share?? I’d like to point you to three factors. To start with, the Deepwater Horizon accident gave the industry a black eye, at a time when a burgeoning ESG movement was taking hold—this led oil executives to shun offshore oil production, even if the returns were superior to shale. Secondly, shale executives overpromised in terms of the economics of shale. We can debate if this overpromise was malicious or just oil industry optimism, but that discussion can be saved for a different time. However, the net effect of this overpromise led E&P executives to believe that shale would have better returns on capital than offshore, particularly as the production could be ramped up and down to take advantage of fluctuations in the oil price—this diverted capital from offshore assets, starving them of capital spending. Finally, there was an odd belief, even amongst many energy executives, that the energy transition would lead to peak oil consumption during the 2020s, implying that long-cycle energy projects, like offshore, were unnecessary.

These factors all colluded to dramatically reduce offshore spending, leading to a wave of industry bankruptcies, consolidations and vessel scrapping. The global fleet of floating equipment bore the brunt of this scrapping, with the benign environment floater fleet shrinking from a peak of 281 vessels in 2014 to around 150 today. I believe that dozens of additional vessels in the global fleet will likely be scrapped as they’ve been stacked for too long, or they’re nearing obsolescence, as the necessary upgrades are impractical.

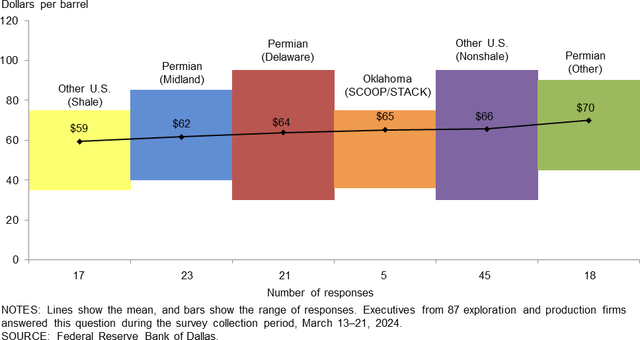

So, let’s start with a simple question; why do I believe that offshore oil will gain market share from shale going forward?? I believe this, because it’s starting to happen. I also believe that this share gain will accelerate, as many of the best shale basins in the US are now mature, and their production growth is stagnating or even declining. Of course, higher energy prices may alleviate some of this production decline, but shale economics simply aren’t that attractive at year-end WTI prices around $70. While some of the best basins may make acceptable returns at today’s prices, those economics erode rapidly should prices decline even slightly (as shown by the break-even prices in the chart below).

Meanwhile, the vast majority of offshore projects have break-evens below $50, while offering far superior returns on capital at today’s prices, when compared to shale. Additionally, as peak oil demand has been pushed out by a few decades, long-cycle projects are once again on the table, and finally are getting prioritized due to their better economics. This is all happening at a time when the global fleet of offshore equipment has shrunk materially due to scrapping, with the expectation that it will shrink further as marginal vessels continue to exit the global fleet.

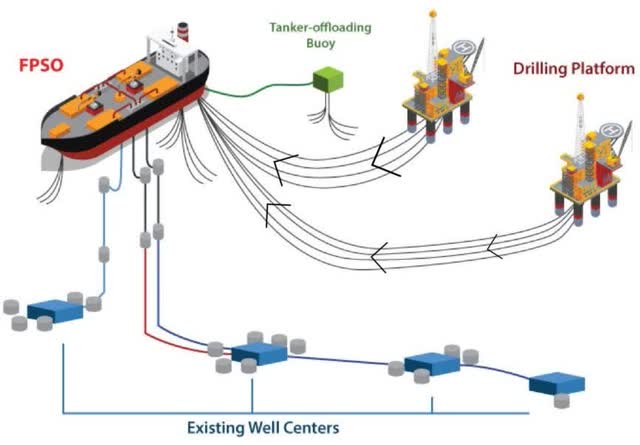

I think it’s worth briefly touching on why the economics of offshore production have improved so substantially in the past decade, from what were already attractive levels (though this letter would be hundreds of pages if I tried to touch on all of the advancements). I hate to generalize as every field is different, but the evolution from undersea pipelines to Floating Production Storage and Offloading (FPSO) equipment has dramatically sped up production, while reducing the prior costs of undersea robots that welded long pipes to shore. This has also served to make oil producing countries less likely to change the rules, as the equipment can simply float away, without the sunk costs of the pipelines. At the same time, upgrades in 4D seismic, along with AI (offshore is ACTUALLY an AI play!!) have meant that there are fewer dry wells, and oil companies can better target where to drill within a target. All of this leads to lower costs, faster returns, and an improved safety profile for offshore energy.

Finally, upgrades in Blowout Preventer (‘BOP’) technology, mean that it’s far less likely that there will be another Deepwater Horizon sort of accident, especially as most modern Drillships now utilize two of them just in case one fails. Additionally, by using 2 BOPs, you can employ Managed Pressure Drilling (MPD) which speeds up the drilling process and makes drilling more precise. Since we’re investing in Drillships, it’s worth mentioning that a modern drillship with the best new technology, can now drill two or even three times as many wells per year as it could back in 2010, which greatly reduces the costs per well, even if the dayrate for the vessel increases (in our wishful thinking).

Modern FPSO in relation to the oil field

Given my prior bullishness on oil, I fully understand if you want to ignore my oil price view, but I believe that our offshore services investment works surprisingly well in a rangebound oil environment between $70 and $90 Brent. Clearly, it works better at higher prices, but I don’t think it suffers too badly in a weak oil environment either. While this isn’t a prediction, I wouldn’t be surprised if this investment also works well in a world where oil drops to the $50s, and shale is forced to surrender millions of barrels of daily production to balance the market. This investment is impacted by the price of oil, but it is not tied to the price of oil. Instead, it is tied to the supply and demand for highly engineered equipment, equipment that takes years to build, and likely will never be built again, unless dayrates and asset values increase very dramatically.

While on the topic of this equipment, it’s important to give a quick history lesson. Historically, this equipment can last for half a century, or more. However, it tends to get obsoleted about every decade due to upgrades to technology and demands for equipment that can drill deeper, faster and with better safety profiles. We’re now on the 8th generation (8G) of such vessels. There are currently 3 of these in the global fleet. In a normal offshore cycle, future 8G newbuilds would obsolete the existing fleet of 57 7th generation vessels (7G). Except, there are zero newbuildings happening, and even if one were ordered today, it would cost in excess of $1 billion and take at least three years to complete.

Of course, no one would build an 8G when they cannot achieve an acceptable return on the invested capital. The return calculation to determine when newbuilds makes sense, is called Newbuild Parity and at current newbuild costs in excess of $1 billion, you’d likely need dayrates of approximately $1 million a day, along with a 10-year contract, to earn the mid-teen return on capital that would incentivize you to take on the risk of building a new vessel. Said another way, there likely isn’t any more equipment coming given current dayrates. What you see is what you get, and the only way that new equipment comes, is if rates go to levels where we make obscene returns on our capital and then continue to earn those returns for the half-decade or more, before multiple new vessels are built and activated. This means that the killer of past cycles, i.e. new supply, is no longer a risk. Should it become a future risk, we will all be celebrating by that time anyway.

I hate to use bad analogies, but since we all have old laptops in the closet, I’m going to run with this for a bit. Imagine taking your 2010 vintage laptop and trying to surf the internet. Sure, it would work, but you’d be amazed at how slowly it goes after you’ve used a modern one—in fact, your old one might not even have Wi-Fi. Now, you could order parts and upgrade your laptop, but it’s going to be clunky, it’s going to be expensive, and it’s going to still be inferior when compared to a 2025 vintage laptop. What if they stopped building laptops forever?? Then, you’d take your newest laptop and continue to evolve it with upgrades over time—you wouldn’t ever try that with your vintage laptop. As a result, your 2010 laptop will continue to lag further behind your newest one. This is what’s happening in the world of offshore. BOPs are expensive, and adding a second one isn’t cheap, nor is upgrading to MPD. 7G vessels justify this expenditure as they’ll be around until the next batch of 8Gs are ordered (if they’re ever ordered) but operators are hesitant to spend on upgrades to 6G equipment, as it increasingly gets obsoleted by efficiency gains in 7G equipment. The spread between the two is widening and it looks like an increasing number of 6G vessels will be sidelined and ultimately scrapped as the decade continues. This is important because vessel quality matters in drilling, especially as many of the newest oil discoveries are happening in places that are deeper, with harsher climates, and are more technologically complex to access.

At this point, it’s probably worth talking about how important the wave of bankruptcies and consolidations over the past decade have been. Let’s look at the modern 7G and 8G Drillship fleet. There are effectively 60 vessels in this fleet (appx. 53 that are active). 48 are owned by the four largest operators (VAL, NE, SDRL, RIG), with 12 owned by additional operators including 2 owned by a Sonadrill/SDRL JV (the numbers of 7G and 8G Drillships can move around at the margin based on which data provider you rely on, as vessel quality definitions can vary, but these numbers are directionally correct). I expect that many of the smaller operators will be consolidated in the future, as there are substantial scale advantages in this industry. In a world where excess pricing accrues to consolidated industries, the level of consolidation in this industry should get you all giddy.

In summary, E&P capital is flowing offshore after a decade-long bear market, the global fleet has shrunk roughly in half, yet the demand for higher quality Drillships is growing. Meanwhile, it’s highly unlikely that any more equipment will get built, until such a time that rates are at a level where we’re all celebrating, and even then, we’ll likely keep celebrating through half a decade of excess profits before the new supply comes.

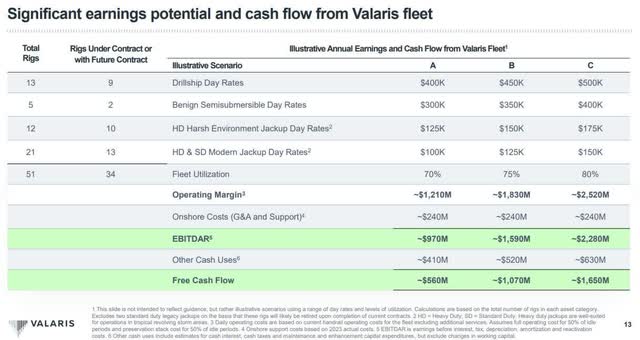

Since Valaris is this Fund’s largest position, I thought it would be helpful to focus the rest of our offshore services discussion on it, though we also have substantial positions in Tidewater, the world’s largest player in Offshore Service Vessels (OSVs) and Noble, another owner of high-spec Drillships. At the close of trading on December 2024, Valaris had a market cap of $3.15 billion, and a net debt position of appx. $800 million (as of Q3 2024), for an Enterprise Value of approximately $3.9 billion. What do you get for this price?? You get 12 of the higher spec 7th Generation Drillships, and 1 of the better 6th Generation Drillships. You also get 5 Semi-Subs, 33 modern Jackups (JU) and a 50% ownership in a JU joint-venture with Saudi Aramco (ARMCO, ARO) that owns an additional 9 modern JUs. By our math, it would cost well in excess of $1 billion to build and activate each fully equipped 7G, and in excess of $250 million per JU. Not that anyone would try to recreate this selection of assets today through a newbuilding program, but you’d be hard pressed to do it for under $25 billion—making our $3.9 billion EV an interesting starting point for us as value investors.

Valaris 10/31/2024 Investor Presentation

I tend to be skeptical of management projections, but according to the Valaris, at a range of dayrates that roughly approximates today’s rates, the company should be able to earn between $560 million and $1.650 billion per year in free cash flow. While we have some quibbles with their math, we believe it is directionally accurate, albeit with a massive range of outcomes. At the same time, you can clearly see how small changes in dayrates lead to massive operating leverage, which is what gets me so excited in this thesis. So, what do we need for these results in Columns A to C to be achieved?? We need current dayrates on multiple active vessels to reset higher from prior contracts that were negotiated a few years ago at roughly half of today’s rates, and we need additional contracts to be procured for some of the highest spec sidelined vessels in the world.

Fortunately, there have been multiple contract signings over the past quarter that give me confidence that current dayrates are bounded by Columns A and C. To achieve these returns, Valaris simply needs to recontract existing vessels. In terms of sidelined vessels, this will take a bit longer, but I believe that an energy company would be foolish to contract a 6G vessel when there’s a 7G one available, even if it needs some time to fully mobilize. I think that both of these issues should resolve themselves by the end of 2026, as lower spec 6G vessels are swapped out for 7G ones. I also tend to believe that based on the number of offshore projects that begin in 2026, there’s a good chance that leading-edge dayrates will begin to exceed the Column C scenario, but I want to temper my enthusiasm. All we need to know is that returns may fall somewhere in this grid, and that provides a very attractive cash flow yield to us as equity owners.

More importantly, that cash flow is being used to retire stock, at a huge and amazingly accretive discount to newbuild cost. To date, Valaris has already repurchased 3.9 million net shares, or approximately 5.1% of the 75 million shares outstanding when it emerged from bankruptcy. As cash flows accelerate in the future, so should the pace of repurchases.

I hope I’ve established that Valaris is a cheap stock, with strong tailwinds. For me, that’s a great starting point for an inflection investment, but I also want to know that if I’m wrong, I’m not going to get hurt too badly. For downside protection, asset value matters, but so does the balance sheet to outlast everyone else. As of October 30, 2024, Valaris had $4.1 billion in backlog at decently high margins, and they were owed $265.4 million from their Saudi Aramco JV. These sum up to approximately half of the EV and more than cover the net debt, even ignoring the equipment value. Should contract signings slow, Valaris has real staying power in a very capital-intensive industry. Said another way, in a downturn, presumably other players will have to stack their equipment before Valaris—though I find that scenario to be highly unlikely.

Of course, downside protection is nice, but we’re in this game to make money. What do we win if we’re right?? Said differently, what’s our upside here?? In the last cycle, dayrates on modern Drillships were north of $700k a day, with modern Jackups well in excess of $250k. Plugging such numbers into the grid above, gives you in excess of $2 billion in annual cashflow. Of course, there’s been a whole lot of inflation in the decade since the prior offshore cycle, and the equipment is arguably far more efficient. OSVs have already taken out their prior cycle peaks in terms of rates, and I don’t see why Drillships can’t do the same. Assuming $1 million a day and $350k for JUs, you get to over $3 billion in Free Cash Flow.

Now, this is shipping and shipping companies tend to not trade on cashflow, as it’s volatile. Instead, they trade on a multiple of NAV where NAV is calculated based on market values for equipment. Since I don’t expect Drillships to trade hands frequently, market values will be tied to newbuild costs, with a discount for depreciation. With newbuild costs likely increasing inline with inflation, looking out a few years, I don’t see why Valaris couldn’t have an implied $30 billion newbuild cost and trade at 1.5 times that cost, as offshore companies have at prior peaks, to account for earning in excess of newbuild parity for the period before newbuilds arrive. This would imply a $45 billion valuation, but that valuation would be applied to substantially fewer shares than are outstanding today, as free cashflow is applied to aggressively reduce the share count. Yes, I know, the potential upside here is extreme. Operating leverage is a beautiful thing when you catch it just right.

At the same time, I’m a realist and I try to be a pragmatist. You can plug in all sorts of scenarios and get outcomes that seem downright ridiculous to the upside. I’m not trying to tell you we’re going to make 100 times our money from today’s price, even if the model above says that’s a potential outcome. At the same time, a man can dream, and that’s the whole point of inflection investing. I try to find scenarios where there are insanely strong tailwinds, coupled with low risks for permanent capital impairment, then I put our capital to work. Interestingly, other highly successful shipping investors are aggressively wading into the offshore services sector during this pullback. John Fredriksen, one of the most successful shipping investors of all time, reputedly worth billions, has publicly disclosed the purchase of over 700k shares Valaris shares in the past 6 months, and he now owns in excess of 9% of the company. The Maersk Family, one of the most successful shipping dynasties, has disclosed the purchase of over 3m shares of Noble, taking their ownership past 19% of the company. The CEO of Tidewater just purchased shares worth approximately $2 million. In the first nine months of 2024, Valaris, Noble and Tidewater have repurchased $101, $250, and $47 million of their shares, respectively. None of this means that we’re going to be successful in this investment, but we’re certainly in good company, and surrounded by people who think these shares are attractive.

This all sounds fabulous, so why are the shares down so dramatically over the past few months?? I hate to blame someone else for our losses, but in this case other investors are central to the narrative. As you’re well aware, the average investor’s time horizon has continually shrunk over the past decade. Investors can no longer look out to 2026 results. In fact, many of them cannot even look out to the first quarter of 2025. They fixate on discrete data points and rate of change. When leading-edge dayrates for high spec Drillships were rapidly increasing from the low $200k range in 2021 into the mid-$500k range in early 2024, investors chased these shares higher. Then, as vessels were reactivated to meet higher pricing, and E&Ps slowed down their drilling campaigns due to infrastructure bottlenecks, leading-edge dayrates stagnated and then dipped below $500k. Investors declared that the cycle had peaked, looked at the pause in contracting, and panic-sold shares—then they went short. The short interest in Valaris has increased from 4.943 million shares on May 31, to 10.091 million shares as of the most recent reading on December 13, and over 14% of the shares outstanding are now short. This swing of the shareholder base, over a handful of contract signings at lower rates, and the expectation that rates may dip further before bottoming, has led to the decline we’re suffering through.

Given how close our Fund is to the industry, we were well aware that dayrates were stalling out and that there would be a pause in new contracting. Clearly oil prices in the $70s instead of the $80s has had some impact here, but you have to remember that E&Ps make long-cycle drilling decisions based on project economics at far lower oil prices. They know that during the decade or two that a field produces, there will be good and bad years. The oil price doesn’t really drive decision-making, though fast-twitch investors seem to believe that the price is all that matters. Rather, the pause in new drilling contracts is tied to the inability of procuring additional FPSOs and various other subsea infrastructure. Offshore cannot ramp without lots of very expensive capital equipment like FPSOs that take years to build. This is the real culprit, and I knew about it. Yet, unlike many other investors, I didn’t sell or hedge or do anything else. You see, a younger version of myself would have taken evasive action, avoided a pullback, and then missed a potential multi-bagger. Now, I simply accept that volatility is part of the investing game. Then again, I’m a bit surprised by the magnitude of this pullback, where a few billion in market cap disappeared over what is a few hundred million in missed cash flow, but such is the nature of capital markets. You can try to outsmart them, or you can accept that they sometimes overshoot. You can be a victim, or you can take advantage of everyone else panicking. I chose to do the latter.

During the past few months, I’ve dramatically increased our exposure to offshore. To finance these purchases, I’ve sold down many other positions, positions like uranium where I’m quite bullish, but do not find as attractive as offshore services. Prehistoric man used to toss virgins into volcanoes to appease the gods and improve crop yields. I toss CUSIPs into the volcano to try and improve portfolio yields. We’re not so different…

So how do I see this investment progressing?? I believe that there will be a few more months, maybe even quarters with subdued contracting. Dayrates may decline further. However, there is a huge call on Drillships and other offshore equipment in 2026, as announced and sanctioned projects ramp up. One of the reasons that this Fund has been so successful over the years is my willingness to look out past a weak patch and accept the volatility along the way. I’m not focused on the next datapoint, I’m focused on the drivers of an upswing in offshore capex for the remainder of this decade, drivers that have been well telegraphed.

I hope that you’re now sick of hearing about offshore. I’ve mostly avoided book reports on individual stocks or sectors in these letters to you, but given how large our exposure is, how Valaris has tied up substantial capital since we first started purchasing it in the second quarter of 2021, and how frustrating the returns on that investment have been, I thought it was important to really dive into what’s driving our losses, why I believe that they’re likely to be temporary, and why the potential upside seems to justify us allocating such a substantial portion of our capital to this sector. Normally, when you own a stock that sees its revenue and cash flows expand, year after year, with good visibility on further growth, while the share count declines, the market usually rewards you. However, 2024 was a strange sort of year, where investors were more focused on other sectors, and our offshore services instead became a source of proceeds, and then a Beta hedge for the rest of their portfolio. This too will pass…

Hey JOE!! Whatcha Doin’ With That Land Over There…???

Since I’m doing book reports this quarter, I want to briefly mention JOE, which comprised 12.5% of our capital at year-end, and was our third largest detractor on a Dollar basis. I tend to focus on hard assets with strong tailwinds, as those assets offer downside protection, with plenty of upside in what I believe to be an inflationary decade. JOE has both of these aspects in spades (tailwinds and asset value).

Let’s look at the tailwinds. As JOE owns a disproportionate percentage of the undeveloped land in Southern Bay, Gulf and Walton Counties, in Florida, along with substantial business operations there, let’s discuss those counties’ growth briefly, as real estate is tied to population and economic activity. I believe that there is no better, nor cleaner metric for both population and economic growth, than the growth in passenger traffic at Northwest Florida Beaches International Airport (ECP). Since 2019 when 1,275,488 people flew through the airport, traffic is up by 30.1% as of 2023 when 1,660,479 people flew through ECP, with traffic up an additional 13.5% this year over 2023, as of November. Clearly, this is impressive growth, and it doesn’t even track the rapid growth of private planes, which tend to be core JOE customers. The Florida Panhandle is a rapidly growing part of the nation, and JOE is in the driver’s seat in terms of how it is developed. By developing it intelligently, JOE doesn’t only add value to each development, but they add value to their massive landbank and all future developments that they undertake. There is a real multiplier effect here and I think that many investors miss this.

As a value investor, I always ask myself what something is worth today, and what it can be worth tomorrow. Valuing JOE’s income producing properties is relatively easy. I can get deep into the math here, but for the sake of simplicity, let’s assume their existing business operations (including full and partial ownership in 12 hotels with 1,298 rooms, multiple multi-family and senior living properties with 1,383 units, 1,179,000 square feet of other commercial space, a clubs business, marinas and a bunch of other assets like self-storage, a gas station and a shooting range) are worth approximately $2 billion, net of the cash and debt on the balance sheet. Then, at the year-end market cap of $2.6 billion, you’re buying approximately 168,000 acres of land in Florida, much of it waterfront, for approximately $3,600 an acre, net of the commercial real estate. I can assure you that this is the wrong price. In fact, I think there’s a genuine agreement amongst investors that this is the wrong price—the disagreement is in regard to the correct price.

I like to think in terms of big numbers. If you assume the Net Asset Value (NAV) of the company today is between $200 and $300 a share, then you can work backwards and calculate that I’m valuing the land at between $57,500 to $92,200 an acre, if you assume that everything else on the balance sheet nets to $2 billion. Looking around at recent transactions on the County Clerk’s website, I have pretty good confidence that this range of outcomes is directionally correct and could be on the low side of things. Of course, JOE has plenty of acres that are worth less than $57,500, but they also have acres that are worth a few million each, which drag the average up rapidly. For the sake of argument here, let’s just accept that my math is correct, and using $250 a share as a midpoint of NAV is accurate.

Having lived in Florida for 17 years, I have seen land in Florida appreciate rapidly. Maybe not every year, and there were a few down years during the GFC, but for the most part, land in Florida, especially land near the water, appreciates rapidly. As a shareholder, I assume this remains the case as the population of Florida, and particularly Bay, Gulf and Walton counties grows. If you assume that this collection of land and operating assets appreciates at 10% a year, which would be roughly the sum of the percentage changes in population growth and the CPI in the counties where JOE has investments, then it would imply that the NAV should appreciate by $25 next year, before the company earns a cent from running their recurring cashflow businesses, or reinvests a cent into new development. Once you add in about two dollars of anticipated cash flow each year, and some value creation on the development side, I feel pretty confident in saying that the NAV can appreciate by $30 next year. Given the year-end share price of $45, that would represent an appreciation of 67%, which is quite attractive in my book. Naturally, this isn’t a one-and-done situation—I expect this sort of NAV appreciation to be an annual phenomenon, though it will be somewhat lumpy and track the economic cycle to a certain extent. Of course, as we’ve learned repeatedly over the past few years, the returns for the stock and the returns for the NAV can remain divergent. While frustrating to us in 2024, I’m trying to predict long-term value creation, and I remain confident that the shares will one day accrete towards NAV.

I’ve had frequent meetings with management, who I think are excellent, over the four years that we have owned our shares. I’ve implored them to close this discount to NAV with buybacks, and they’ve done some occasional buybacks, but they’ve mostly focused on developing the land that they have. At first, I found this frustrating, now I’m more accepting. Let’s return to the math again. Let’s say they had bought back $100 million of shares during 2024 at an average price of $50, or at 20% of NAV, that would have been incredibly accretive. They would have created $400 million of incremental NAV value for everyone!! Amazingly, there’s something else that they could do that would be more accretive. Imagine if they instead spent $100 million on building a new hospital (the first in the region), along with a new marina, town center, restaurants, etc., all amenities that retired people likely desire when they are researching about where to retire (JOE built all of these things in 2024). To be more accretive than buybacks, JOE would need to add more than $400 million in value to their land through these investments. Do I think these improvements have added approximately $2,400 per acre in incremental value to the 168,000 acres they have ($400 million / 168,000 acres = $2,400)?? Of course!! Their land has probably appreciated by far more than $2,400 an acre. How can you sell high-end homes to retired people when the nearest hospital is over an hour away?? Even better, these amenities are going to produce cash flow, allowing the company to continue to reinvest at an even more rapid pace in the future. In summary, buybacks are nice, but developing property is even nicer, as we get added cash flow, value uplift on successful developments (trust me, that concrete and steel is worth a lot more than the $100 million they spent on it), and value uplift on the surrounding 168,000 acres as well.

The problem with this is that while the stock market is usually correct over long periods of time, it is lazy and downright stupid over short periods of time. Since we started buying shares of JOE throughout 2020 at approximately $20 per share, the shares have appreciated by 122%, but I feel strongly that NAV per share has appreciated even more rapidly. One day, this valuation gap will close, but without more aggressive buybacks, this may take some time. As noted in the case of Valaris, I’m perfectly fine to be patient and wait for the market to notice what I take for granted.

Of course, nothing is ever linear, and you may be wondering why the shares of JOE have performed so poorly in the last few months of 2024. I can point you to rising interest rates, a US housing slowdown (which doesn’t appear to have really impacted JOE) and other macroeconomic factors, but the primary cause of the price decline is JOE specific. Funds managed by Bruce Berkowitz currently own 29.7% of JOE. These funds have continually sold shares, and that has capped the price of JOE over the past few years. When Bruce chose to resign as Chairman of the company, after a 13-year stint where he successfully oversaw the turnaround at JOE, shareholders panicked that his funds would accelerate their pace of share sales. I see this as a short-term concern. Shareholders periodically sell shares. The long-term business prospects are not impacted by this. I focus on the long-term here. If Bruce chooses to sell additional shares after they’ve already declined by approximately 30% from the 2024 peak, then that just seems like a buying opportunity for us, and the company, should they choose to become more aggressive on their buyback.

As this book report is now getting quite long-winded now, I want to wrap this segment up. This Fund has always employed a concentrated strategy. When our names are doing well, this concentration has created really strong outperformance. When two of our core themes, Offshore Services and JOE, (comprising 46.1% of our capital at year end) do poorly, it negatively impacts our results. In many ways, this is why most funds choose to be more diversified. For me, I believe that outperformance can only come from being concentrated—with the expectation that over short periods of time, it may lead to added volatility.

Economic Views and Positioning

As noted last quarter, I’m increasingly of the view that the US economy is slowing. How much it is allowed to slow before more fiscal and monetary stimulus are applied is hard to discern. However, it does appear to be slowing—particularly in sectors tied to the consumer. This slowdown now appears to be impacting industrial sectors as well.

As mentioned, I’ve used this knowledge to continue reducing exposure and improving the overall liquidity of the portfolio, by culling many of our smaller and less liquid securities. This harvesting phase is almost complete, with a few stragglers still left to be disposed of.

My expectation is that the economy continues to slowly deteriorate, until the next round of fiscal or monetary stimulus is unleashed. While many investors rushed into US equities after the Trump victory, I see MAGA policies as likely bearish for the sorts of high-multiple growth companies that they’ve chosen to purchase. I see MAGA as a set of policies that is likely to produce higher levels of inflation and higher interest rates. These two factors would be quite negative to most large-cap stocks. That said, I believe our sorts of businesses should thrive in such an environment.

As noted above, I’ve used the weakness in our offshore services names to add substantially to those positions and have harvested many other positions to fund the purchases. After many years of having employed leverage and relatively high levels of net exposure, I have taken exposure down even further, in expectation of the potential for downside movement in 2025. Additionally, I’ve added a number of longer dated put spreads, and will be looking for potential opportunities on the short side—for the first time in ages. In summary, we have a heavy weighting in a number of sectors that should do well in an inflationary environment, but we’ve taken our exposure down in order to be more flexible. Event-Driven continues to work for us, and in the volatile environment that I foresee, I’m going to be allocating more capital towards that strategy.

Position Review (top 5 position weightings at quarter end from largest to smallest)

Oilfield Services and E&P Basket (Valaris (VAL – USA), Tidewater (TDW – USA), Noble (NE- USA) other undisclosed positions)

Please see notes above.

Emerging Markets Basket

For the past decade and change, Emerging markets have been in a relative bear market, as investor capital has migrated to US markets. In the process, many emerging markets have gotten quite cheap when looking at them from a valuation perspective. This fund has a sweet spot for cheap assets, but Emerging Markets have been cheap for quite some time now. You could have said the same thing years ago and likely be sitting on paper losses today, while having tied up capital. What you need is a catalyst that unlocks this value. I believe that catalyst is a potential decline in the US Dollar, tied to policy changes emanating from the Trump Administration. For MAGA policies to work, the US needs to follow a weak Dollar policy. At the same time, Emerging Markets, which frequently borrow in US Dollars, are hamstrung by a strong dollar, but a weakening dollar is a boon to their economies. As a result, I’ve built up positions in various Emerging Markets that are highly impacted by the US Dollar, with a view that a weakening Dollar should be a catalyst for asset values.

St. Joe (JOE – USA)

Please see notes above.

A-Mark (AMRK – USA)

As the world gets increasingly crazy, I believe that people will come to realize that ownership of precious metals in physical form, as opposed to in a brokerage account, is part of being financially prudent. They will mostly likely buy those coins from a coin dealer, either in person, or online. A-Mark supplies both of those markets as one of the largest players in online coin brokerage through their JM Bullion, LPM, Silver Gold Bull, Goldline, etc. verticals, along with serving as one of the largest wholesalers to local coin shops. A-Mark also has stakes in two mints (Silver Towne and Sunshine).

A-Mark benefits from periods of chaos in two ways. They see transaction volumes increase, and they see the spreads that they can charge widen. During the three years from Fiscal 2021 to 2023, A-Mark earned approximately $7 a share per year on average if you adjust for certain non-recurring items and remove non-cash intangible amortization. We acquired our shares for approximately four times this earnings level, which seems quite cheap for a business with such high returns on capital. That said, the business has seen reduced earnings over the past few quarters, as a result of declining transaction volumes and spreads. I believe that this decline in activity has created a unique opportunity to buy a high-quality business, with substantial insider ownership, at a bargain price. I naturally am enamored of the counter-cyclical nature of the business, which hopefully should help offset the risks to our portfolio in future periods of crisis.

I believe that this business can earn as much as $10 a share in such a period of crisis, and get a healthy multiple applied to it.

For years, I have sought out a way to play an increase in the prices of precious metals, without the risks of owning a mine. I believe that A-Mark is the ideal proxy for this view and as other investors discover it, the valuation will re-rate.

Sprott (SII – USA)

Sprott is an asset manager that primarily manages exchange traded vehicles in various commodity sectors, with a focus on precious metals and uranium—two sectors that I’m quite bullish on. Sprott earns management fees based on the assets under management and in a virtuous cycle where they experience both inflows and asset appreciation, the fees should grow rapidly on a fixed cost basis, creating dramatic operating leverage.

I should note that on an earnings basis, Sprott is a good deal more expensive than most businesses that we tend to invest in. That said, I believe that this valuation is deserved and likely to increase due to the quality of the business and its scarcity value. With gold having made a new all-time high in US Dollars, investors will continue to seek out ways to gain leverage to precious metals, without the risks of mining.

In my universe of companies, only A-Mark and Sprott offer this sort of leverage with any amount of liquidity. As investors also discover this, I believe that they’ll bid both of these companies higher. While we could have just bought more A-Mark, I felt that diversification was warranted, especially as this Fund already owns just under 5% of A-Mark. Besides, Sprott gets us added exposure to uranium, a sector that I’m also bullish on.

Returning to the markets, during the fourth quarter of 2024, the Fund experienced a negative return, and I remain quite frustrated by our results. We are positioned for a financial and economic crisis that always seems to be postponed by yet another quarter. In the interim, a handful of mega-cap tech stocks have dominated global market performances, making my conservatism look foolish. The current markets remind me of 1999 and early 2000, when idiotic themes would act as a vacuum for all of the world’s liquid capital. Themes like AI are absorbing all the capital from value names, and investors, out of frustration, appear to be selling their cheap stocks to buy the stocks that are working. I believe we’re now near the very end of this process, and I refuse to join in. My expectation is that the flows will reverse soon, likely as Trump gets going on his policy actions, and our sorts of names will once again work. Markets go in cycles, and I remain convinced that my favorite names will have their day in the sun (eventually). Though, the waiting can be maddening.

I know that there are empirical metrics that I can use to judge the relative value of our portfolio against other snapshots in time. Price to cash flow is precisely imprecise, as cash flow is volatile, while price to book is more precise, though ascertaining the true book value of illiquid assets is difficult. I prefer to simply try to be unemotional, and realistic, in terms of where I think our portfolio trades at any moment in time. In my mind, at year-end, our portfolio is the cheapest it has been since the depths of the Covid Crash in March of 2020. There has been no other moment that feels this mispriced since we launched our fund. If you have been waiting for a moment to invest additional capital, this feels like an opportune time. Please contact Nick Cousyn ( [email protected]) if you want intra-month commentary on how the book is performing, should you look to add additional capital. We cannot time bottoms, but we can tell you when we feel like things are unusually cheap. They feel cheap at year-end, though they can always get cheaper.

For our offshore clients, we should also note that we have obtained an ISIN and will be making our offshore offering available through Euroclear for trading, execution, and settlement, allowing international investors direct access from their custody accounts, if they so choose. This is intended to streamline onboarding and reduce operational friction on both sides. Again, please reach out to Nick if this is of interest.

Lastly, we are also introducing a bi-annual, client-only conference call with the first one occurring on February 5, 2025 at 2pm EST. This call will be open to all current clients and will provide updates on our current positions, macro and thematic outlook, along with a live Q&A session. Given that this letter gets posted publicly, we will send all clients a direct email with more information and a registration link.

I want to thank you again for your investment with me. We’ve had a great run at this Fund, and in many ways, we were overdue for a down year. Hopefully, this will not be repeated for quite some time.

Sincerely,

Harris Kupperman | Founder & Chief Investment Officer

|

Appendix

Net return varies from gross return as it accounts for management fees and incentive allocations. Please see the additional disclaimers on the final page of this document. Disclaimer This document is being provided to you on a confidential basis. Accordingly, this document may not be reproduced in whole or part and may not be delivered to any person without the consent of Praetorian PR LLC (“PPR”). Nothing set forth herein shall constitute an offer to sell any securities or constitute a solicitation of an offer to purchase any securities. Any such offer to sell or solicitation of an offer to purchase shall be made only by formal offering documents for Praetorian Capital Fund LLC (the “Fund”) or Praetorian Capital Offshore Ltd. (collectively, the “Funds”), managed by PPR, which include, among others, a confidential offering memorandum, operating agreement and subscription agreement, as applicable. Such formal offering documents contain additional information not set forth herein, including information regarding certain risks of investing in a Fund, which are material to any decision to invest in a Fund. No information in this document is warranted by PPR or its affiliates or subsidiaries as to completeness or accuracy, express or implied, and is subject to change without notice. No party has an obligation to update any of the statements, including forward-looking statements, in this document. This document should be considered current only as of the date of publication without regard to the date on which you may receive or access the information. This document may contain opinions, estimates, and forward-looking statements, including observations about markets, industries, and regulatory trends as of the original date of this document which constitute opinions of PPR. Forward- looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Actual results could differ materially from those in the forward-looking statements due to implementation lag, other timing factors, portfolio management decision- making, economic or market conditions or other unanticipated factors, including those beyond PPR’s control. Statements made herein that are not attributed to a third-party source reflect the views and opinions of PPR. Opinions, estimates, and forward-looking statements in this document constitute PPR’s judgment. PPR maintains the right to delete or modify information without prior notice. Investors are cautioned not to place undue reliance on such statements. Return targets or objectives, if any, are used for measurement or comparison purposes and only as a guideline for prospective investors to evaluate a particular investment program’s investment strategies and accompanying information. Targeted returns reflect subjective determinations by PPR based on a variety of factors, including, among others, internal modeling, investment strategy, prior performance of similar products (if any), volatility measures, risk tolerance and market conditions. Performance may fluctuate, especially over short periods. Targeted returns should be evaluated over the time period indicated and not over shorter periods. Targeted returns are not intended to be actual performance and should not be relied upon as an indication of actual or future performance. The past performance of the Fund is not indicative of future returns. Net returns presented have been calculated net of fees, including a 20% incentive allocation, with up to 2% expenses from inception through December 2020, and a 1.25% management fee since January 2021. All returns reflect the reinvestment of dividends and do not include the performance of a side pocket portfolio. While the Fund undergoes annual audits, the returns presented have not been independently verified. The performance reflected herein and the performance for any given investor may differ due to various factors including, without limitation, the timing of subscriptions and withdrawals, applicable management fees and incentive allocations, side pocket participation, and the investor’s ability to participate in new issues. There is no guarantee that PPR will be successful in achieving the Funds’ investment objectives. An investment in a Fund contains risks, including the risk of complete loss. The investments discussed herein are not meant to be indicative or reflective of the entire portfolio of the Fund. Rather, such examples are meant to exemplify PPR’s analysis for the Fund and the execution of the Fund’s investment strategy. While these examples may reflect successful trading, not all trades are successful and profitable. As such, the examples contained herein should not be viewed as representative of all trades made by PPR. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here