Earlier in the year, I wrote an initiation article on the Strive U.S. Energy ETF (NYSEARCA:DRLL), cautioning investors against the fund as there was no clear differentiating factor between DRLL and other cheaper options. While DRLL claims to “unlock value in the U.S. energy sector by mandating companies to focus on profits over politics”, given DRLL’s size, it was unlikely to make a material impact.

With 9 months of additional performance data, let us see if our initial assessment was correct.

Brief Fund Overview

The Strive U.S. Energy ETF aims to provides broad market exposure to the U.S. energy sector. However, according to the manager’s vision and mission statement, Strive’s goal is to unlock value by advocating for companies to focus on ‘profits over politics’ (Figure 1).

Figure 1 – DRLL mission statement (DRLL factsheet)

Strategy In Detail

Broadly speaking, the DRLL ETF is meant to be ‘anti-ESG’, as it is marketed to investors fed up with ESG proposals that have been “crammed down investors’ throats by fund companies and the media”.

According to the firm’s ethos, Strive aims to “prioritize the shareholder over other stakeholders” by rejecting large asset managers’ tendency to “[incorporate] non-pecuniary factors under the guise of considering environmental, social, and governance risk factors.”

Specifically, according to DRLL’s proxy voting guidelines (stated in the fund’s prospectus), the DRLL ETF will use its proxy voting powers to vote “in favor of board members and proposals that the Firm believes will lead companies to be mission driven, customer centric, innovative, merit-based, and financially disciplined.” The DRLL ETF “will vote against proposals and board members that the Firm believes will not best advance these objectives. “

Portfolio Materially Undifferentiated With Peers…

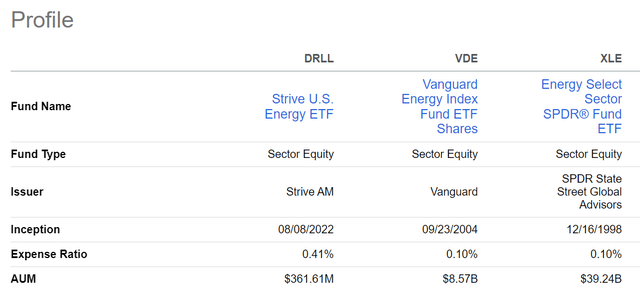

The DRLL ETF has $354 million in assets and charges a 0.41% expense ratio.

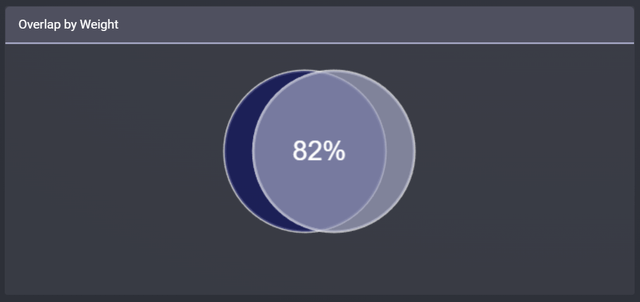

My main concern with DRLL is that aside from the proxy-voting claim, my review of the fund’s holdings show that it is materially similar to other cheaper funds from Vanguard and SSGA. For example, analyst David Sommer showed that the DRLL ETF had an 89% overlap with the Vanguard Energy Index Fund ETF (VDE). Similarly, DRLL has an 82% overlap with the Energy Select Sector SPDR Fund ETF (XLE) (Figure 2).

Figure 2 – DRLL has an 82% overlap with XLE (etfrc.com)

…With Higher Fees…

However, the DRLL ETF is 4x more expensive, charging a 0.41% expense ratio compared to 0.1% for both VDE and XLE (Figure 3).

Figure 3 – DRLL charges 4x the fees compared to peers (Seeking Alpha)

…And Lower Returns

Higher fees may be acceptable if DRLL’s strategy can generate superior returns. Unfortunately, that does not appear to be the case as the DRLL ETF has lagged VDE and XLE on a YTD basis (Figure 4) and since inception (Figure 5).

Figure 4 – DRLL has lagged VDE and XLE YTD (Seeking Alpha)

Figure 5 – DRLL has lagged VDE and XLE since inception (Seeking Alpha)

How Has DRLL Voted?

With respect to DRLL’s voting record, let’s see whether DRLL actually kept their word. Investors should note that a fund’s voting record is available at the SEC as form N-PX.

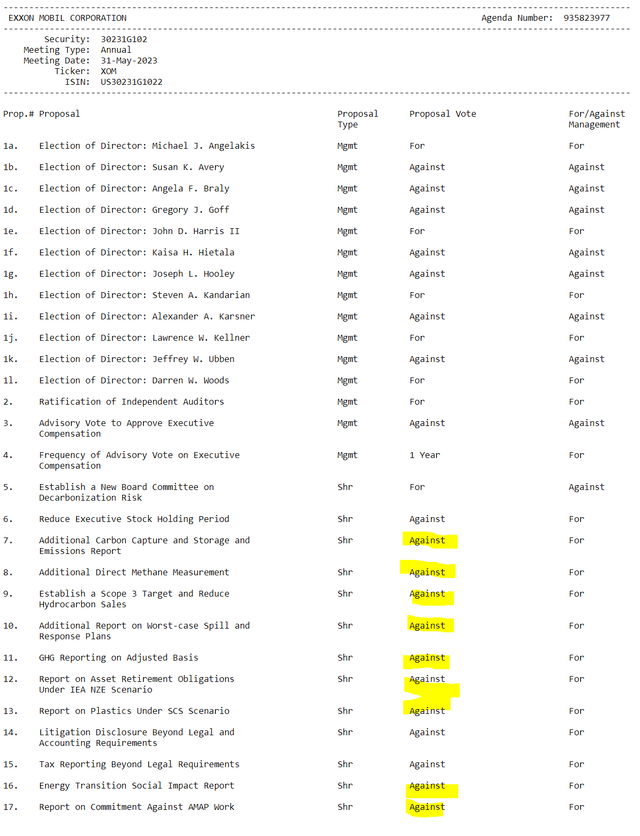

For example, on Exxon Mobil’s proxy, DRLL voted against all the ‘ESG’ shareholder proposals (Figure 6).

Figure 6 – DRLL’s vote on XOM proxies (SEC)

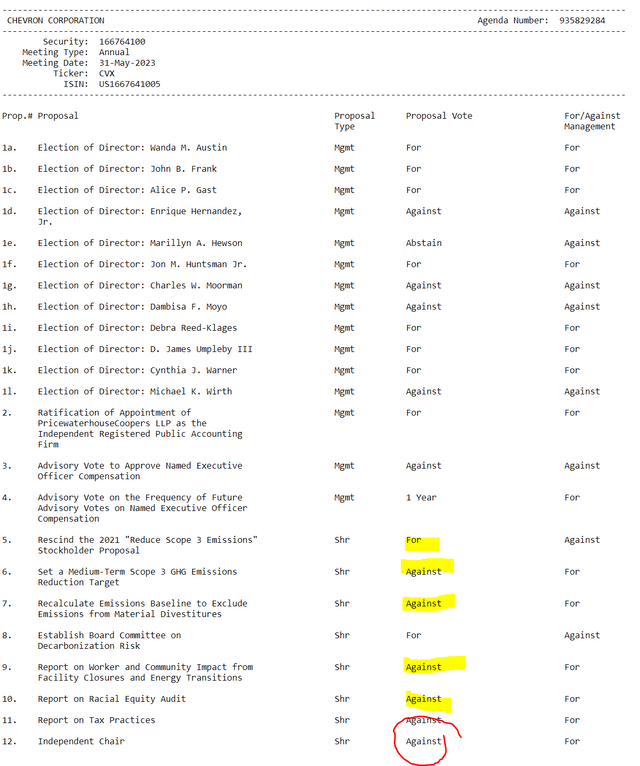

Similarly, DRLL voted against shareholder ‘ESG’ proposals at Chevron (Figure 7).

Figure 7 – DRLL’s vote on CVX proxies (SEC)

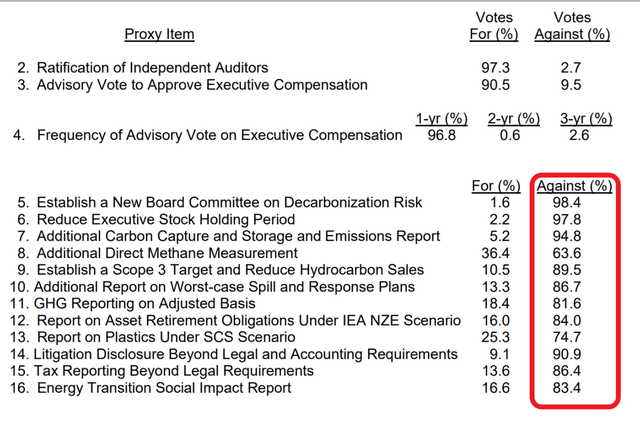

However, I have 2 comments about these votes. First, if we look at Exxon’s proxy results, shareholders were overwhelmingly against these ‘ESG’ shareholder proposals in the first place, so did DRLL’s voting do anything besides saying the quiet part out loud (Figure 8)?

Figure 8 – XOM shareholders were overwhelmingly against these proposals in the first place (XOM proxy voting results)

Moreover, DRLL voted against having an independent chairperson for Chevron. From DRLL’s voting guidelines, DRLL vote proxies in the best interest of the fund. Why does DRLL consider having an independent chairperson being against the fund’s best interest?

According to common board best practices, an independent chairperson would allow the board to better carry out its primary duty of monitoring management of the company and its executive on behalf of shareowners. How is that a bad thing for unitholders of DRLL?

Conclusion

In summary, the Strive U.S. Energy ETF claims to unlock value through superior corporate governance practices. However, as I initially noted, the DRLL ETF has not shown any indication that this strategy leads to superior performance for the fund. In contrast, the fund continues to lag passive peers since inception.

Furthermore, looking at DRLL’s voting record, many of the shareholder proposals the DRLL ETF voted against were highly unpopular with investors in general. So aside from allowing DRLL to market its ‘corporate governance strategy’ to retail investors, it serves no real purpose.

In fact, DRLL voting against an independent chairperson at Chevron may be detrimental to unitholders of DRLL, since a combined CEO/Chairperson may wield unchecked power at Chevron.

I am all for ‘leaving politics outside of investing’, but my concern is that Strive may be capitalizing on ‘anti-ESG’ sentiment to sell an expensive and underperforming fund to retail investors. I continue to think investors should stick with ‘tried and true’ investment vehicles like the VDE and XLE ETF for their energy exposure.

Read the full article here