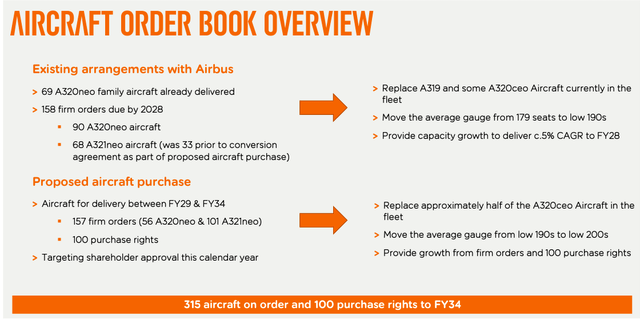

Last week, easyJet (EJTTF, ESYJY) disclosed its Fiscal Year 2023 trading & business update. As a reminder, our supporting overweight was backed by 1) consumers’ resiliency to spend more on travel despite inflation, 2) a solid balance sheet, and 3) new planes to support passenger growth and expand the company’s profitability thanks to lower fuel consumption and lower OPEX expenses. In our last publication, we reported how the “new aircraft will consume 20% less fuel and have a 4% additional passenger capacity“. The last company update fully confirmed our thesis. Indeed, before commenting on the numbers, it is crucial to communicate that the British low-cost operator announced an order for 157 Airbus aircraft, subject to shareholder approval, in addition to the conversion of another 35 aircraft. In detail, the carrier decided to modify a previous order of 35 A320neos to a larger A321neos to cover the higher travel demand expected. In total, this operation, which is part of the company’s fleet replacement program, will affect the years 2029-2034 and will cost approximately $19.9 billion. The agreement also includes an option for EasyJet to purchase other 100 aircraft. This is not a surprise; here at the Lab, we recently reported how Ryanair signed a deal to buy 300 new aircraft, and Air India communicated the higher order for a total commission of 470 planes from Boeing and Boeing. We believe these orders will likely lead to a supply-demand problem (and this is another risk to consider in valuing the easyJet investment story).

easyJet new plane order

Source: easyJet Q4 results presentation

Why are we still positive?

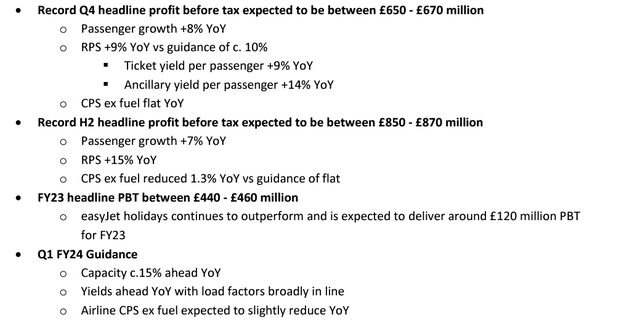

- EasyJet pricing power continues to hold up. This is supported by a travel rebound, higher frequency flyers, and tourists with lower budgets who decide to use low-cost operators. In numbers, passengers grew at 8% on a year-on-year basis;

- RPS is guided at a plus 9% and was at 10% before; however, the company noted that costs ex-fuel are lower than anticipated and fell by 1.3% on a yearly basis;

- The company had anticipated a Profit Before Tax between £440 and £460 million, which was in line with our expectations. Therefore, we apply no changes in our forward numbers. In addition, we note that the sell-side might like to revise the easyJet forecast upwards, driving a material lift in EBITDAR appreciation (and consequently to the company’s target price);

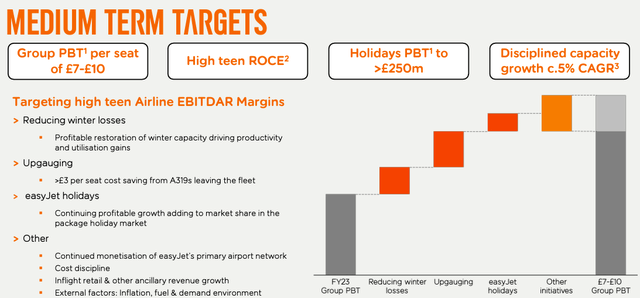

- In addition, the company reiterated its near-term guidance with a plus 15% additional capacity in Q1. EasyJet aims for a profit before tax of at least £1 billion, elevating its PBT per seat to £7/£10 from £5 (Fig 2). This level is not seen since Fiscal Year 2015. easyJet strategy is built on four pillars: 1) reducing winter losses, 2) updating the fleet, 3) growing Holiday’s market share penetration, and 4) driving ‘other initiatives.’

-

In our guidance, we estimate higher unit costs in H2 2024 due to higher fuel prices, and even if management is optimistic about benefiting from operating leverage, we prefer to remain cautious. In H1, the company continues to expect flattish costs, and in our model, we forecast a yearly revenue line of £9.1 billion, confirming a passenger growth of 30%, which translates into 2.5 million passengers;

- The company will resume its dividend payment with an expected payout of 10% and 20% in 2023 and 2024, respectively. This equals a yield of 1% and 2.5% (at the current market price). This was already well priced in our estimates;

- For the winter season, the CEO expects demand to continue to be sustained, despite fears of economic recession and fluctuations in the cost of fuel, which will be covered with hedging policy; however, if the Ukraine and Israel conflict might be longer than expected (or escalated to adjacent countries such as Iran and Libano), fuel costs might heavily impact easyJet P&L;

- The airline, which has suspended connections with Israel, said it wants to start flying to Tel Aviv again as soon as possible. Traffic to other countries, such as Egypt and Turkey, has (so far) not been affected.

easyJet Financials in a Snap

Source: easyJet Q4 press release – Fig 1

easyJet mid-term outlook

Fig 2

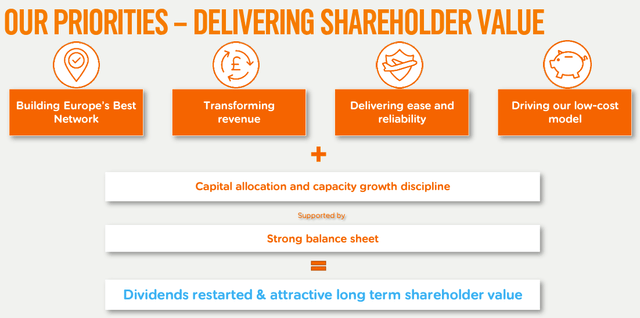

easyJet’s capital allocation priorities

Fig 3

Conclusion and Valuation

Looking at our three key supporting pillars, 1) easyJet is growing, 2) in 2023, the company was able to reduce debt, including a bond repayment of €500 million in February and a refinancing with an additional $550 million lower debt (it is now a zero debt company). Subject to shareholder approval, easyJet made progress with a proposal for a new fleet (as happened with Ryanair), and we believe they will likely receive a green light.

According to our estimates, easyJet trades at 3x our Fiscal Year 2024 EBITDAR versus a pre-COVID-19 median of approximately 7x. This current valuation suggests a bankruptcy scenario. Therefore, despite potential pressure on fuel price, we continue to overweight the low-cost operator, confirming our target price of 560p per share, representing a c36% upside. In addition, we should also include forecast dividend estimates with a payout (as mentioned above) of 1% yield for 2023 (and a potentially higher yield in the next visible period 2024-2025 of 2.5%). The 2023 EBITDAR reached £1.13 billion and thanks to higher passenger growth, we anticipate a 2024 EBITDAR of £1.24 billion. In our estimates, we derive a 2024 EPS of 56p, and with a valuation target P/E multiple of 10x, we confirmed our target price. As a reminder, easyJet P/E was at an average multiple of 15x in the past five years average. Against a complex macroeconomic backdrop, EasyJet valuation remains undemanding, coupled with solid fundamentals. We also liked the company’s capital allocation priorities, and our buy rating was then confirmed. Downside risks include lower-than-expected passenger volume in the Winter Period with a limited Christmas holiday vacation due to inflation, UK strikes, higher litigation risk, and higher competition from other low-cost operators such as Ryanair and Wizz Air. Fuel price volatility combined with an escalation in the Middle East might provide a more expensive oil price environment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here