In May of this year, Kenvue (NYSE:KVUE) completed its separation from Johnson & Johnson (JNJ).

The transaction, which was initiated in November 2021, separated out JNJ’s personal care and over-the-counter medicine brands from the pharma conglomerate and thrust them into the icy hands of the public markets.

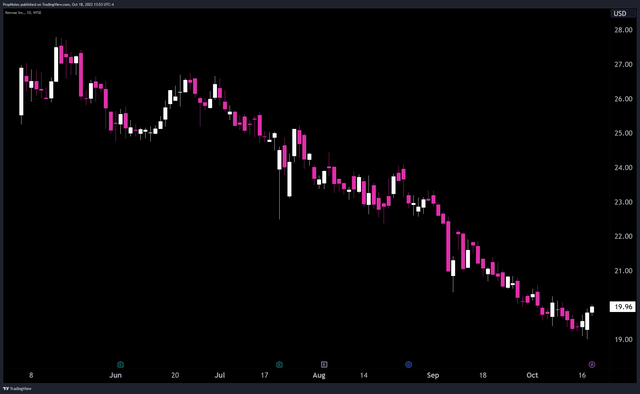

In that time, investors have not been kind.

Since the transaction’s completion, KVUE stock has drifted downwards more than 20% as ‘ho-hum’ reactions to earnings and a lackluster macro backdrop have driven the stock into its own personal bear market:

TradingView

However, we think the company is massively underpriced and could richly reward investors who get involved at this juncture.

Today, we’ll take a look at the company, its products, its prospects, and its valuation in order to determine the best course of action as potential investors in the new SpinCo.

Sound good?

Let’s dive in.

Financial Results

As always, let’s begin with KVUE’s Financial results.

As you may expect, the company’s financial statements don’t go back very far, but there’s more than enough here to work with.

From the top down, KVUE seems like a straightforward company.

The company has three main product categories: Self Care, Skin Health & Beauty, and Essential Health:

Kenvue

These categories are packed with well-known brand names you’re likely familiar with, including the following (From KVUE’s 10Q):

“Self Care. Our Self Care product categories include: Cough, Cold and Allergy; Pain Care; and Other Self Care (Digestive Health, Smoking Cessation, and Other). Major brands in the segment include Tylenol, Nicorette, and Zyrtec.

Skin Health and Beauty. Our Skin Health and Beauty product categories include: Face and Body Care and Hair, Sun and Other. Major brands in the segment include Neutrogena, Aveeno, and OGX.

Essential Health. Our Essential Health product categories include: Oral Care, Baby Care, and Other Essential Health (Women’s Health and Wound Care). Major brands in the segment include Listerine, Johnson’s, BAND-AID, and Stayfree.”

As it turns out, these brands have quite a solid market position, given the resulting financials.

As of KVUE’s most recent quarter which reported in July, roughly $4 billion in quarterly revenue was turned into ~780 million in operating profit, of which roughly $430 million was reported as bottom-line net income.

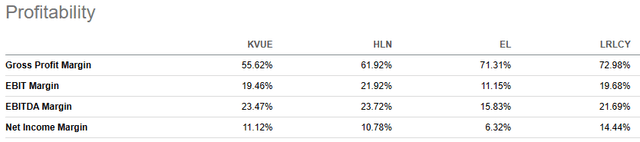

Margin wise, this represents operating margins of ~20%, and net income margins of 11% – not bad for a company in the consumer staples sector.

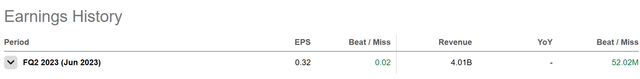

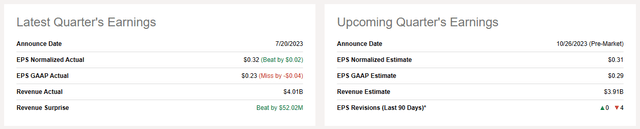

The recent numbers also came in ahead of wall street expectations, as the company beat on both top and bottom lines:

Seeking Alpha

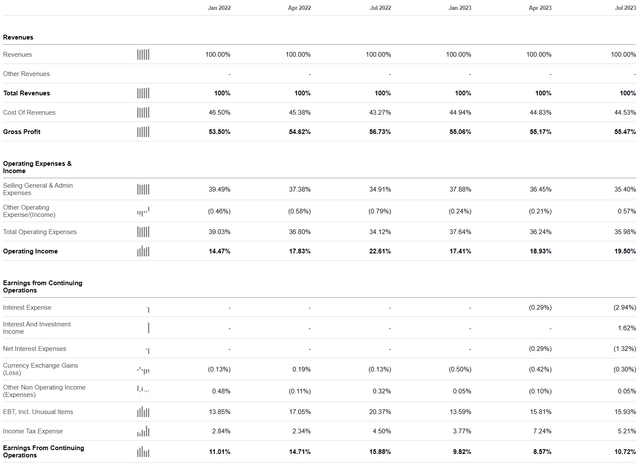

The exciting bit here is how stable KVUE’s margins and growth have been. Through the last year and a half, KVUE has produced consistent gross margins between 53%-56%, stable operating margins between 15%-20%, and solid net income margins centering around ~11%:

Seeking Alpha

This makes sense given the inelastic nature of demand for KVUE’s products; nobody is going without Zyrtec during allergy season, and everyone will continue to use a BAND-AID in the event of the odd scrape or cut.

While the stability is nice, the real key here is the surprising growth. Between July 2022 and July 2023, KVUE increased top line revenue by 13%; impressive given the poor consumer macro conditions and the high level of market saturation present.

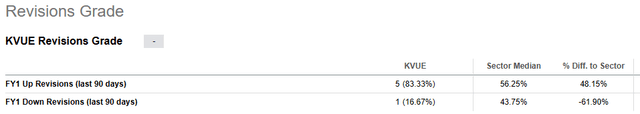

That is why, in 7 days when KVUE reports Q3 earnings, we’re expecting more of the same – growth and consistency. Currently, analysts have been revising their projections for Q3 lower, but this seems largely irrelevant in light of the positive FY23 revision action which is well above sector median:

Seeking Alpha

Seeking Alpha

But the real question here is whether or not JNJ saddled the company with debt, as is common with Spinco’s (like WBD)? Thankfully, the answer is no, for the most part.

Right now, KVUE carries roughly $7 billion in debt, which stands up against about $8.9 billion in tangible assets. Combined with KVUE’s robust FCF, the debt doesn’t appear to be a serious issue for the company and shouldn’t weigh on earnings too heavily.

Next, let’s take a look at why our mouth is watering.

The Valuation

Hedge Fund Manager Steve Mandel once said:

I don’t need an analyst to tell me when a 10 PE stock is cheap. I need an analyst to tell me when a 40 PE stock is cheap.

The implication here, of course, is that the mean reversion performance one might get from looking for deep value opportunities is actually less than the performance of a stock that looks more expensive, but may actually be relatively undervalued vs. peers or future prospects.

This is a great way of looking at KVUE.

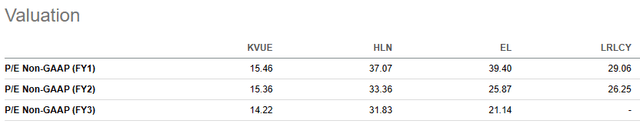

While the stock isn’t nominally ‘cheap’ at 15 FWD PE, we believe that the value here is much greater than the market is giving it credit for.

For one, the company is considerably ‘cheaper’ than its peers.

Estee Lauder (EL), L’Oreal (OTCPK:LRLCY), and Haleon (HLN) all trade at a significantly more expensive valuation:

Seeking Alpha

This valuation seems unjustified, especially given that all four companies are comparable in size, product mix, and net income margin:

Seeking Alpha

As a result, it’s hard to see KVUE as anything other than another unjustly beaten down Spinco.

To us, fair value would be around a FY2 PE of 24. In that scenario we would look to re-work our thesis a little bit depending on how quickly the stock got there. One could make the case that fair value deserves to be much higher around a PE of 30, but we’re looking to be conservative. Even from that conservative lens, the value proposition is still stark.

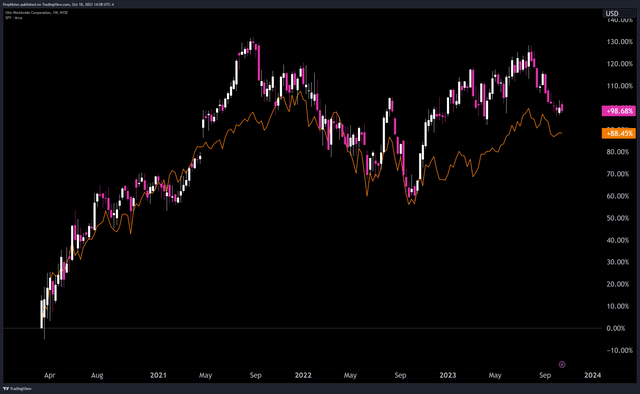

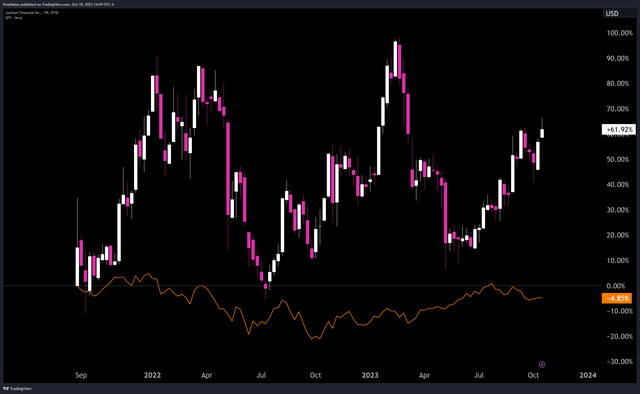

In addition, many of these recent spinoff companies have gone on to perform quite well over time.

Just take a look at OTIS, RTX’s recent elevator company divestment, or JXN, Prudential’s (PRU) U.S. retirement play that it opted to get rid of. Both companies have outperformed the market since inception:

TradingView

TradingView

To us, KVUE is a similar opportunity. Yes, it hasn’t performed well out of the gate, but it’s been a tough macro backdrop for all stocks that don’t directly benefit from the secular AI narrative, like Apple (AAPL) or Nvidia (NVDA).

We suspect that as the market begins to get acquainted with this company, it will like what it sees.

Some have argued that the income generation potential here is low, which is a simple fix: just sell covered calls against your position.

Summary

To us, the combination of stable earnings, solid underlying growth, an inelastic demand profile, and a considerable valuation discrepancy vs. peers all present a compelling package to investors just arriving at this story now.

This isn’t to say that the bottom is in yet, necessarily, for the stock. However, we think the time is right to begin looking at adding a position, then dollar cost averaging over time.

Given the inherent value in KVUE’s simple-but-compelling products and strong unit economics, we think it’s only a matter of time until shareholders reap the rewards of owning shares in the company.

If you enjoyed this article, then give us a follow and be sure to share it with a friend who may enjoy it.

Cheers!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Read the full article here