With the OSV market in the midst of a super-cycle, Tidewater (NYSE:TDW) appears the best way to play this trend.

Company Profile

TDW operates a fleet of offshore service vessels (OSV) that are used to support various aspects of the offshore crude oil and natural gas industry, as well as the windfarm industry. Its vessels provide a number of services including towing and anchor handling for mobile offshore drilling units; transporting supplies and personnel; offshore construction support; geotechnical survey and seafloor evaluation; and other specialized services.

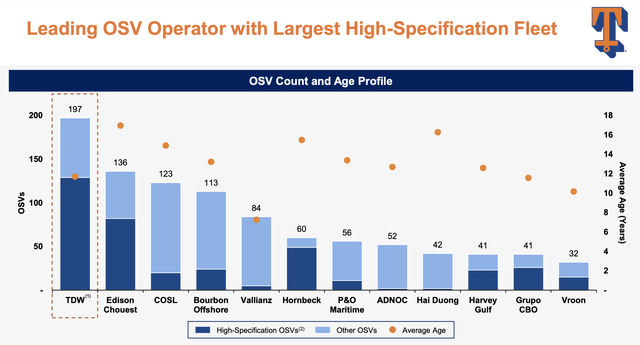

The company currently has 223 vessels, including 197 OSVs. Of its vessels, 141 are platform supply vessels (PSV) that are designed to carry a variety of cargo, including fuel, water, drilling fluids, and segment in below deck tanks, as well as carry materials such as casings, drill pipes, and tubing on an open deck. It also has 56 anchor handling supply vessels (AHTS) that are used for towing, anchoring and other subsea operations. It also has 17 crew boats, 6 offshore tug boats, and 3 specialty vessels.

TDW Fleet (Company Presentation)

Opportunity & Risks

One of the biggest opportunities for TDW is benefiting from increasing day rates for its vessels. The company has seen a strong increase in day rates over the past few years. In 2021, it was getting a day rate of $10,950, which went up to $12,803 last year. Leading edge term contracts, meanwhile, were $21,186 in Q1 of this year and $23,498 for Q2.

Rates, meanwhile, are only expected to continue to go up and possibly hit all-time records in 2024. This is a remarkable turnaround for the industry, which looked on its deathbed not too long ago. However, the stressed period for the industry before the pandemic led to increased scrapping and lay-ups, and almost no newbuild activity. With vessels laid up for more than 5 years now, reactivating them becomes increasingly time and cost intensive and thus less likely. With oil prices high and offshore drilling returning, this is starting to leave a supply-demand imbalances in some regions as there is suddenly now a shortage of vessels. This is leading to higher day rates as well as better contract terms, such as no cancellation for convenience clauses.

Discussing the current state of the OSV market on its Q2 earnings call, CEO Quintin Kneen said:

“As we’ve discussed frequently, day rate improvement is the primary driver of increasing profitability of our business, particularly as we look at the intermediate to long-term offshore cycle unfolding. As such, we remain focused on a variety of tactics to continue to drive global average day rates. We were successful in our tactics to continue to push day rates globally. This strategy did have a short-term utilization impact. We consciously chose to forego certain immediate contracts to pursue higher day rate opportunities. And in some cases, we incurred frictional unemployment related to relocating vessels and waiting on customers for projects to commence. The combined opportunity cost to revenue for this strategy was approximately $8 million from loss utilization during the second quarter. We are confident that this chartering strategy is right for the intermediate and long-term profitability of the business, as we not only achieved higher day rates in the short term, but continue to push the baseline day rates for certain vessels that will prove beneficial as we progress through the remainder of ’23 and into 2024 and beyond.”

With no newbuilding activity and day rates strong, TDW has turned to acquisitions to increase its fleet and boost results. Since the start of 2022, the company has made two acquisitions. In March 0f 2022, it acquired Swire Pacific Offshore for $190 million, consisting of $42 million in cash and 8.1 million Jones Act warrants, which was 15.6% of TDW’s shares outstanding at the time.

Swire brought with it 50 OSVs, comprising of 29 AHTS and 21 PSVs. The deal added more large vessels to TDW’s fleet and lowered its average age. Given the current price of vessels – it costs about $65 million to build a new OSV – this deal turned out to be a steal.

More recently, the company bought 37 high-specification PSVs from Solstad Offshore for $577 million in March of 2023. The deal once again high-graded TDW’s fleet with younger, larger vessels. Given the cost of newbuild vessels, while at a much higher price, this was once again a nice deal for TDW.

For newbuild vessels to get a return on capital given current high interest rates, day rates need to average about $38,000 a day, which should continue to keep upward pressure on day rates and the number of newbuilds ordered low.

The biggest risk to TDW is a shift in the market. OSV operators were devastated during the last oil price crash, with a number of companies filing for bankruptcy, including TDW. The company emerged from Chapter 11 with less debt and the market has since turned, but it shows the risks involved. Thus, a major crash in oil prices would be the biggest risk the company faces.

The OSV market tends to be very cyclical, where strong times are often met by a rush to build new vessels. This in turn creates supply issues when the oil market turns and offshore drilling services weaken. Right now, though, the market is still on the side where vessel supply is struggling to meet demand and day rates aren’t priced high enough to bring in more newbuild ships.

After emerging from bankruptcy and with the day rate rising, TDW is only 1.2x leverage based on its projected 2023 EBITDA. However, in the event of a crash in the market, day rates can go below operating costs.

Valuation

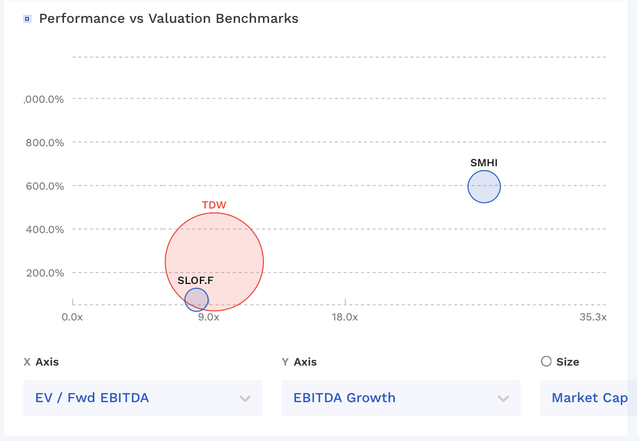

TDW stock currently trades around 9x the 2023 consensus EBITDA of $393.1 million and 5.5x the 2024 consensus of $646.7 million.

It trades at a forward P/E of 20.4x the 2023 consensus of $3.30 and 9.0x the 2024 consensus of $7.49.

It’s projected to growth revenue by over 56% this year and over 33% in 2024.

There aren’t many U.S. traded OSV stocks anymore, with SEACOR Marine Holdings (SMHI), the other notable one. TDW trades at a lower valuation than SMHI.

On a per ship basis, it trades at about $15.7 million per vessel based on its 223 vessels. That’s pretty much in line with the $15.6 million per vessel it spent acquiring ships from Solstad, although these ships were newer and larger and should command a higher valuation than its overall fleet. That said, day rates have also continued to improve.

TDW Valuation Vs Peers (FinBox)

Conclusion

TDW appears to be in the midst of an OSV super-cycle, where day rates are going up because demand is outstripping vessel supply in some geographic areas, but they are not high enough yet to justify newbuilds, especially given where interest rates are, making the cost to finance them high.

With an average contract duration of under 1 year for legacy TDW vessels and ~6 months for the ships it just acquired from Solstad, it should continue to benefit from increasing day rates as contracts roll off. This is a nice set-up moving into 2024.

If you value TDW off the transaction price per ship from the Solstad deal, the stock is probably pretty close to fairly valued. Given the current momentum in the market, though, I think the stock can probably continue to move higher along with day rates. As such, I’m going to rate the stock a “Buy.”

Read the full article here