Thesis

Over the last few weeks, I researched Argentinean and Italian banks extensively. However, it’s time to put a bridge between LATAM and Europe with Banco Bilbao Vizcaya Argentaria (NYSE:BBVA). It is a Spanish bank operating in several countries but primarily in Mexico, South America, and Turkey. BBVA is a controlling shareholder of Banco BBVA Argentina (BBAR), which I analyzed a week ago.

BBAV is a macroeconomic bet on Turkey and Mexico’s growth potential. The bank has an excellent balance sheet, growing profitability, and distributes more than adequate dividends. Based on Excess Return Valuation, BBAV is overvalued; however, compared to its peers, the bank is cheap using the price-to-book and price-to-sale ratios.

I give BBAV a strong buy rating despite being overvalued, measured with Excess Return methodology. Being cheaper than its peers while paying dividends and having excellent financials is good enough for such a rating.

Company Overview

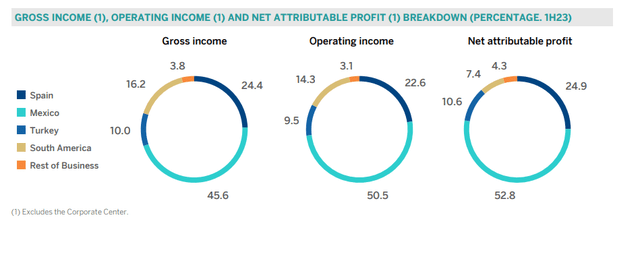

BBVA is a traditional bank with subsidiaries in Spain, Turkey, and LATAM. The heavyweight source of revenue is Mexico. The image below from the last corporate presentation shows the revenue distribution by geography.

BBVA presentation

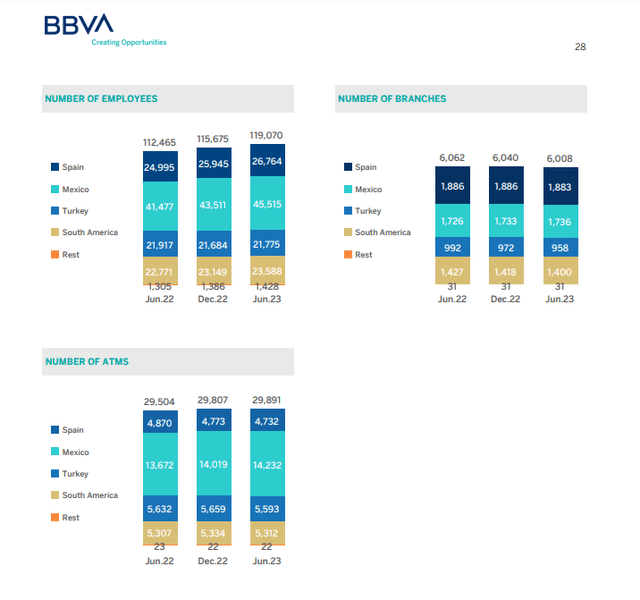

Peru, Colombia, Argentina, and Mexico add up to three-quarters of banks’ revenue and profits. The image below shows customer reach by country.

BBVA presentation

In Mexico, BBVA is the largest bank with over 20% market share. In July 2000, BBVA merged with Bancomer. The latter is one of the oldest banks in Mexico, founded in 1932.

Apart from Spanish-speaking LATAM, Turkey is a peculiar subsidiary. BBVA initially acquired a stake in Garanti Bank in 2015. Later, in 2022, BBVA increased its position to 86%, thus fully controlling the bank. Nowadays, Garanti BBVA bank is among the largest banks in Turkey, with a 20% share of total deposits and loans denominated in Turkish Lira.

Usually, I am not excited about companies with such scattered holdings in areas with distinct cultures and regulations. However, BBVA is positioned in some of the best-emerging markets, Turkey and Mexico.

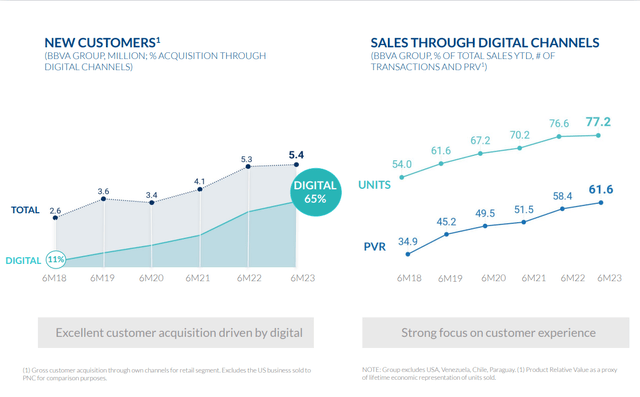

All traditional banks have new competitors. Neo banks lead the pack when talking about digital banking services. However, BBVA is among the best old-school banks entering the digital market quickly in every country where they operate. The graphs below from the last company presentation show BBVA’s digital presence.

BBVA presentation

The data goes back to 2018. BBVA has made progress. The customer growth is constant, along with the total customer base. The former now presents 65% of the latter.

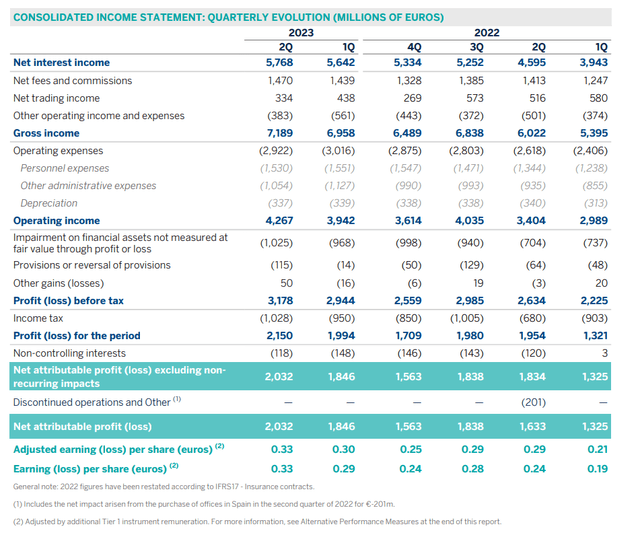

The last quarters were very profitable for BBVA. Higher interest rates for longer are good for banks` net interest margins, as seen below in the image from the previous company presentation.

BBVA presentation

Personnel and administrative expenses, despite the inflation, remain relatively flat. For a bank of such caliber as BBVA operating in an inflation environment, especially Turkey, it is a notable achievement.

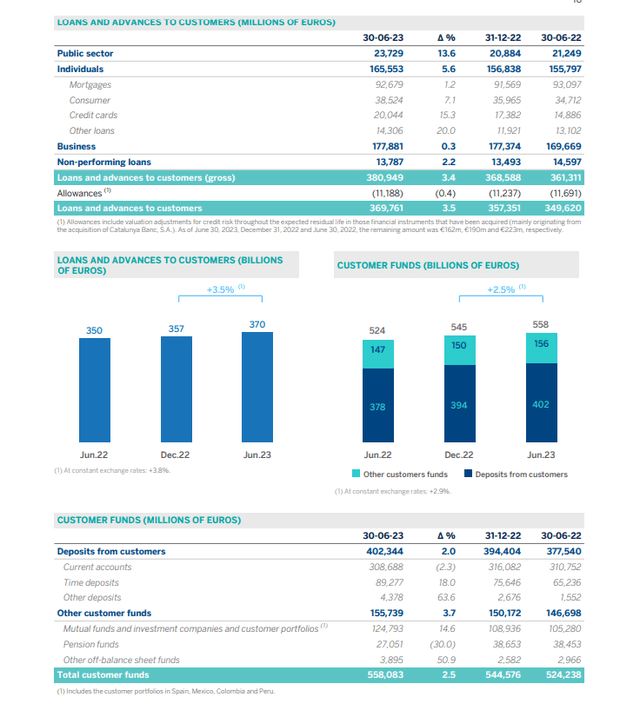

Stable costs and growing revenues translate into an improving efficiency ratio. The graph below shows operating expenses and efficiency ratio (cost to income).

BBVA presentation

The Mexican peso was among the strongest currencies in the last 12 months. However, BBVA kept its expenses stable, given that Mexico’s operations are the company`s largest.

Company Financials

BBVA has a healthy balance sheet. Below is a table showing some metrics to assess banks’ solvency and liquidity. The data is from the last financial report.

|

Asset ratios: assets structure |

|

|

Cash/Total Assets |

9.4% |

|

Loans (ex. credit cards)/Total Assets |

54.4% |

|

Credit cards/Total Assets |

2.6% |

|

Bonds/Total Assets |

18.5% |

|

Liability ratios: capital structure |

|

|

Deposits/ Total Liabilities |

76% |

|

Other liabilities/ Total Liabilities |

2.3% |

|

Company bonds/ Total Liabilities |

17.9% |

|

Equity/ Total Liabilities + Equity |

6.8% |

|

Solvency ratios: |

|

|

Loans /Deposits |

80% |

|

Cash/Deposits |

13.3% |

|

Borrowings (inc. bonds)/ Total Assets |

16.6% |

The numbers are in line with the large European banks. However, there are a few differences. The loan-to-deposit ratio is lower due to banks’ operations in emerging markets. BBVA is a banking conglomerate, so its subsidiaries issue bonds to finance its operations. That said, bond financing represents 17.9% of total liabilities.

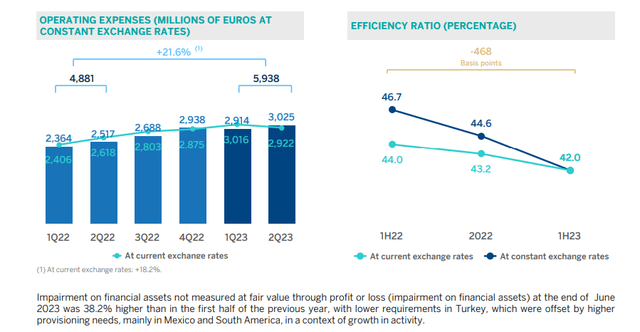

Bank loans and deposit composition is shown in the graph below.

BBVA presentation

The loans are equally distributed between individuals and businesses. The customer loans are well diversified between mortgages, consumer loans, and credit cards. The customer loans portfolio has increased by 5.6%. The major drivers are credit cards and other loans (primary overdrafts). The business loans did not grow notably. Compared to Q2 2022, the change is a mere 0.3%.

The right side of the bank’s balance sheet is composed primarily of current accounts. They represent 76% of total deposited funds. This is a drawback because the current account is the most liquid deposit. They could be withdrawn at any time. On the positive side, they bear a much lower interest rate than time deposits and saving accounts. Hence improving the bank’s efficiency ratio and the company`s bottom line.

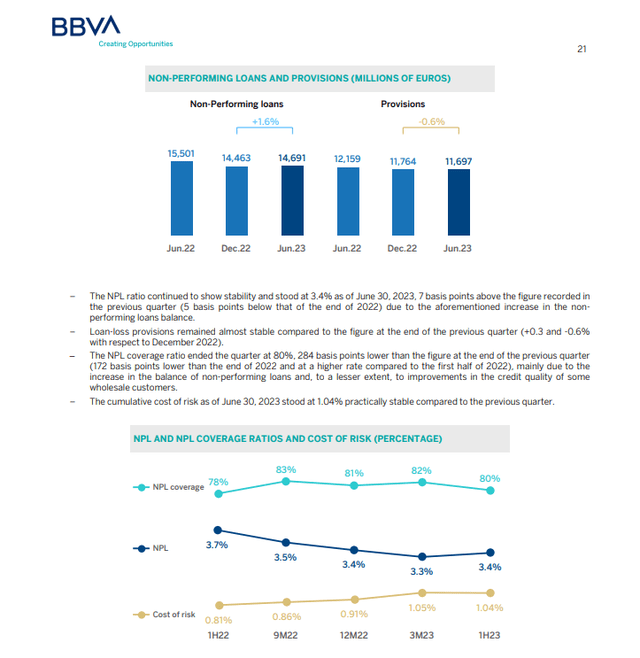

Credit risk is the ability of its borrowers to meet their debt obligations. Two crucial metrics assess borrowers’ default risk: non-performing loans and cost of risk. Below is a table showing BBVA`s NPL, cost of risk, and NPL coverage.

BBVA presentation

NPL has dropped notably while the cost of risk soared. The cost of risk is the ratio of provisions recognized by a bank over a given period (annualized) to the average volume of the loan portfolio. For European banks, those numbers could be more impressive. However, BBAV has operations in Turkey and LATAM. It is worth mentioning from the three primary sources of income, Spain, Mexico, and Turkey, Spain has the highest NPL. The numbers for each country are presented below from the CEIC database.

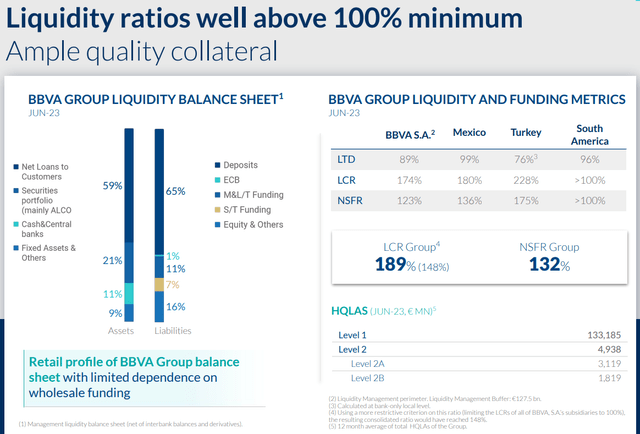

The following crucial metrics for banks’ health are examining their liquidity and debt issuance quality. The image shows liquidity metrics by region and banks` balance sheet composition.

BBVA presentation

It is worth mentioning the loan-to-deposit (LTD) ratio between the countries. In Mexico it is 99%, while in Turkey it is 76%. The latter is justified with the runaway inflation, while the first is high for my taste. Despite Mexico being one of the emerging markets with excellent growth potential, I prefer LTD less than 95%. BBVA consolidated LTD, however, is 89%. Liquidity Coverage Ratio (LCR) and net stable funding ratio (NFSR) are more than adequate at the group level and for the bank`s subsidiaries viewed separately.

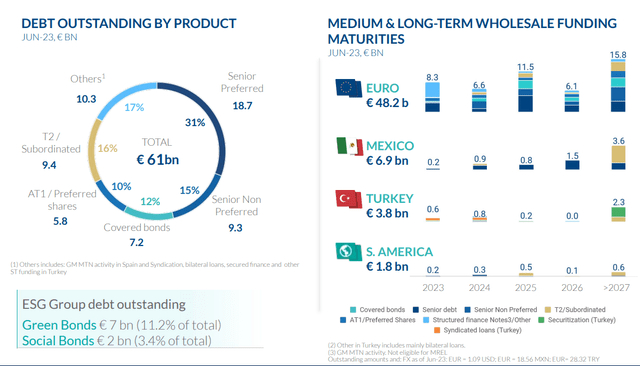

The image below shows banks’ funding by debt issuance by type and region.

BBVA presentation

Most of the debt is senior preferred and senior nonpreferred. Both represent 47% of the total outstanding debt. The remaining 53% are well diversified among lower-priority debt and equity instruments. Geographically, most of the debt is issued by European subsidiaries.

Various portions of banks’ debt will reach maturity in the next few years. More significant amounts of the company`s debt will mature beyond 2024. The first major round is in 2025, followed by 2027. Going deeper, the high-priority debt is issued by banks` European subsidiaries while T2 /subordinated dominates LATAM and Turkish subsidiary’s issuance.

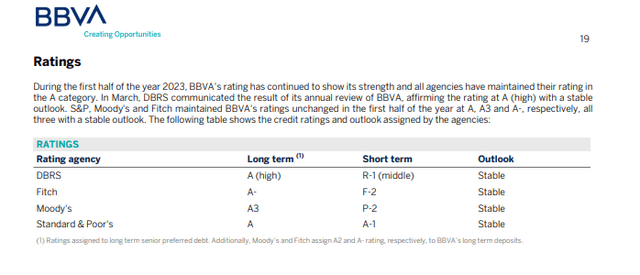

One crucial metric for any bank debt is its credit rating. Given the markets where BBVA operates, its rating is impressive. The latter is shown in the table below from the last bank presentation.

BBVA presentation

The rating agencies are unanimous regarding BBVA’s debt quality, giving investment in the upper medium scale. The debt quality is related to the bank’s liquidity risk.

Any bank analysis is imperfect without mentioning Basel III guidelines. The table below shows BBVA`s metrics. The data is taken from the last financial report.

|

Capital (in billions of euros): |

|

|

Regulatory Capital |

58.0 |

|

Tier 1 capital |

51.2 |

|

Common equity tier 1 (CET1) |

45.6 |

|

Risk-Weighted Assets |

347 |

|

Basel III Ratios: |

|

|

Regulatory capital ratio (Capital adequacy ratio) |

16.79% |

|

Tier 1 ratio |

14.77% |

|

CET1 ratio |

12.99% |

|

LCR |

174% |

|

NSFR |

123% |

BBVA is a strong performer, while not excellent compared to European banks like UniCredit and LATAM banks like BBAR. That said, the numbers are good enough to provide a liquidity buffer in an economic downturn. Besides, BBVA solvency metrics are above the EU average.

BBVA’s profitability has been improving in the last quarters. The table below illustrates the bank`s performance using a few variables measuring how efficiently it deploys its capital.

|

ROE |

16.2 % |

|

RoTE |

16.9 % |

|

RoCET 1 |

17.7 % |

|

ROA |

1.13 % |

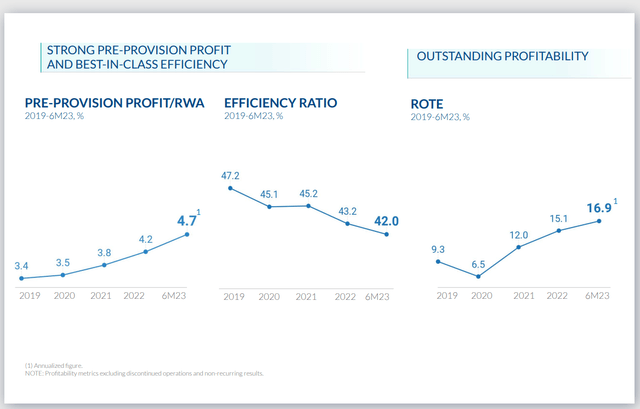

The numbers are above average. Banks will flourish in the new market paradigm dominated by higher rates for longer. BBVA is not an exception. The table below is a proof of that statement. It shows the bank`s performance since 2019.

BBVA presentation

Since 2020, the bank has improved its profitability. The efficiency ratio is the core that predetermines the company’s bottom line. In 2019, the efficiency ratio was 47%, and in the last quarter dropped to 42%. This 10% decline is the main driver behind RoTE and RORAC growth.

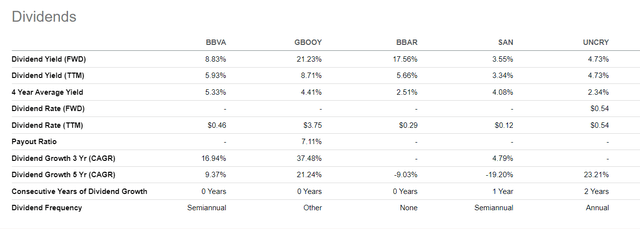

Given better results, BBVA pays nice dividends. Below, I compare BBVA’s dividend metrics with a few other major banks.

Seeking Alpha

BBVA holds the middle ground with a respectable 8.83% yield.

Company Valuation

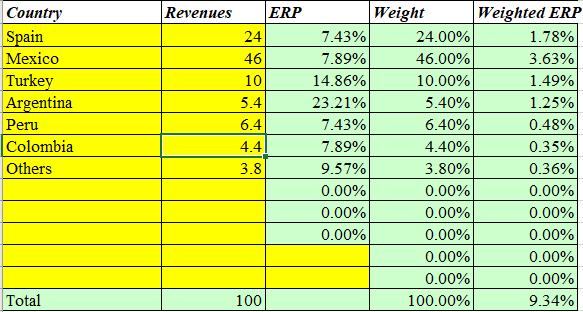

For the valuation of BBVA, I use the Excess Return Model. I do follow Professor Damodaran’s framework and its database.

Assumptions and inputs:

- Risk-free rate equals the 5Y average of USA long-term Government bond Rate, 2.2%.

- Growth rate, g, equals the 5Y average of the USA long-term Government bond Rate, 2.2%.

- BBVA’s global equity risk premium (ERP) is 9.34 %. BBVA operates in Spain, Turkey, and LATAM; thus, to assess its equity risk premium, I weigh each country based on its revenues, thus obtaining weighted ERP.

Author database

- BBVA’s book value per share is $ 8.69 (Sept 17, 2023).

- BBVA’ unlevered Beta 1.53

- BBVA Debt/Equity ratio 339 %.

- BBVA’s effective tax rate 5Y average 29.2 %.

- BBVA ROE (TTM) 16.2 %

1. Calculate Levered Beta with the formula below:

Levered Beta = Unlevered Beta * (1+D*(1-T)/E).

2. Calculate the discount rate (discount rate as the cost of equity) using the resulting value for leveraged beta. The formula I use is:

Cost of Equity = Risk-Free Rate + (Levered Beta * Equity Risk Premium).

3. Calculate Excess Returns using GGAL’s ROE, Book Value, and Cost of Equity:

Excess equity return = (Stable Return on equity – Cost of equity) x (Book Value of Equity per share).

4. Calculate Excess Returns Terminal Value assuming perpetual constant growth and stable cost of equity:

Excess Returns Terminal Value = = Excess Returns / (Cost of Equity – Expected Growth Rate).

6. Calculate the Value of Equity.

Value of Equity = Book Value per share + Terminal Value of Excess Returns.

For BBVA, I get the following results:

Terminal Value of Excess Returns Per Share = $ (1.75)

Intrinsic value per share = $ 6.94

Current market price = $ 7.67 (Sept 17, 2023)

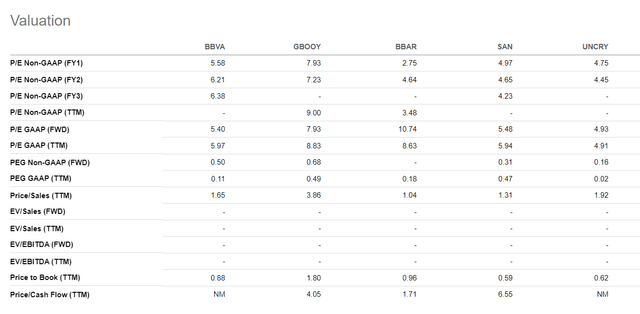

Based on excess return calculations, BBVA is overvalued by 14 %. In the table below, I compare BBVA with Grupo Financiero Banorte (OTCQX:GBOOY), Banco BBVA Argentina, Banco Santander (SAN), and UniCredit (OTCPK:UNCRY).

BBVA presentation

Its Mexican peer, GBOOY, is the most expensive from the group, using price to book and price to sales. BBVA’s book value is below one, and its price to sales is 1.65. Simply said, the latter is how much we pay to buy banks interest revenue. BBAV offers excellent value based on price-to-book and price-to-sales ratios.

Risks

Besides the common banking risks such as liquidity, credit, market, and operational, BBAV carries regional political and economic risks. Its considerable exposure to Mexico and Turkey brings some uncertainty. While the Mexican peso is among the strongest EM currencies, the Turkish lira is among the weakest. Mexico might benefit from friend-shoring and reshoring trends, while Turkey is among the best middle powers navigating between all geopolitical power centers. Both countries have outstanding demography compared to all developed countries, thus providing long-term tailwinds for foreign investments. However, to catch that opportunity, we have to pay the price, i.e., the political and economic uncertainties inherent in all emerging markets.

BBVA is doing well regarding the usual risks, given its balance sheet composition, Basel III metrics, and debt credit rating. The operational risk is complex to assess because of its qualitative nature. However, BBVA has a long history of operating in LATAM, and the bank has built expertise in Turkey for the last eight years.

Conclusion

BBVA is a European bank with the majority of its operations in Mexico, Turkey, and South America. What might be seen as a drawback is an advantage. Mexico and Turkey, for different reasons, are well positioned to capitalize on the emerging macro and geopolitical trends. BBVA might benefit from that, having most of its income from those two countries.

BBVA has a robust balance sheet, excellent Basel III metrics, improving efficiency, and pays nice dividends. I give a strong buy rating due to those advantages and despite the higher valuation based on Excess Return.

Read the full article here