Investment thesis

KLA Corporation (NASDAQ:KLAC) seems to be trading just above its fair value, when taking into account outstanding financials, however, because of the short-term negative sentiment in the semiconductor still lingering, and the hesitancy of investors putting money into any company that is exposed heavily to China, I give it a hold rating, until it reaches my PT. Also, you can get paid while you wait for it to come down with a simple options strategy.

Outlook that may keep share price low

What I believe will be the short-to-medium-term hindrances for the company are the geopolitical risks between the US and China. People are hesitant to invest in companies that have a lot of exposure to China during this time. This is significant for KLAC because 30% of its revenues come from China. If there are further tensions between the countries and more bans going to come in the near future on either end, I would expect a lot of volatility in the share price, which may present a good entry point for the accumulation of shares for the long-term hold.

We have seen how the semiconductor industry has been hit over the last year because of inventory buildup and general negative sentiment of the industry. This will last a little while longer as many semiconductor companies have projected soft revenue numbers for the remainder of the year and into the beginning of the year, which coincides with the report made by Gartner in the first quarter of the year. The global semiconductor industry is expected to decline by around 11% and will experience a substantial bounce back of around 18% if everything goes according to the assumptions. It seems to me that this may be a decent estimate of the future because the companies I’ve covered in the past in the industry are a lot more upbeat when it comes to FY24 and FY25.

Financials

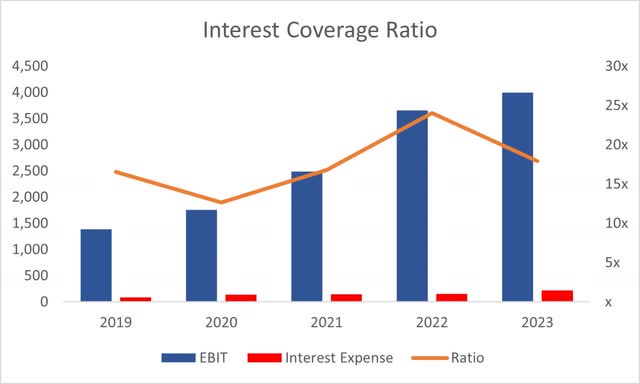

As of FY23, the company had around $3.2B in liquidity, against $5.9B in long-term debt, which has decreased by almost $1B y/y. Debt is not a problem in my opinion, especially now that the company is paying it off. Interest expense on debt stood at around $300m, while EBIT stood at around $3.8B, which means the interest coverage ratio is around 12x. This means EBIT can cover the interest expense on debt 12 times over. I usually look for companies that can at least cover the interest 5 times over, so it is safe to say that the company is at no risk of insolvency. On top of that, their interest expense is softened by the marketable securities which earned interest of around $100m for the year.

Interest Coverage Ratio (Author)

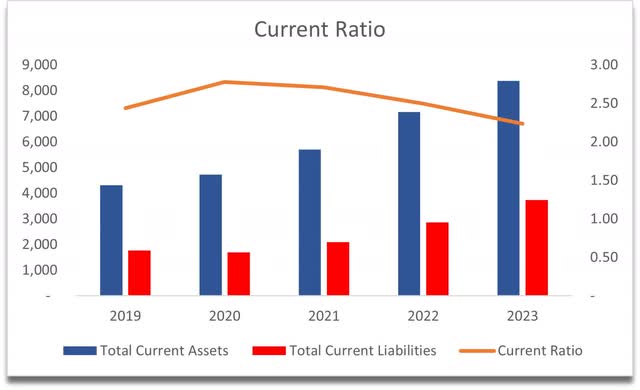

KLAC’s current ratio has also been in the range of what I call to be an efficient current ratio. It’s not too high to be a waste of assets like cash that could be used to expand its operations and further growth, and it’s not too low that it’s hard to cover short-term obligations. The company has no liquidity issues.

Current Ratio (Author)

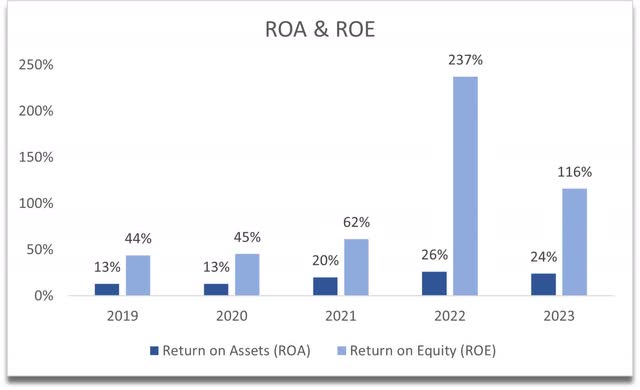

In terms of efficiency and profitability, the company’s ROE has been inflated significantly due to the debt, and since it has started to pay that debt off, it is coming down to a more reasonable return, however, still too high and I can’t take too seriously until it comes down to its historical average of around 30%-40%, which is still really high and above my minimum of 10% but it just means the company is good at utilizing shareholder capital efficiently and is creating value. The company’s ROA is also very decent and well above my minimum of 5%, which tells me the management is utilizing the company’s assets very efficiently. If we look at the competition, it seems that KLAC is at the top range in terms of ROA.

ROA vs Competition (Seeking Alpha) Historical ROA and ROE (Author)

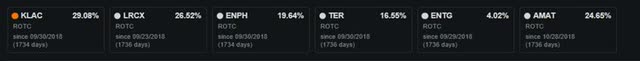

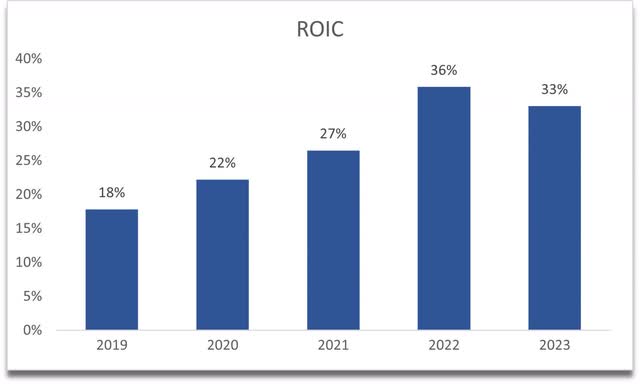

The company also has the best return on invested capital compared to its competition, which tells me it has a good competitive advantage and a strong moat, and for that alone, I would be willing to pay a premium on shares. This is a very high ROIC and well above my minimum of 10%.

KLAC ROTC vs competition (Seeking Alpha) ROIC (Author)

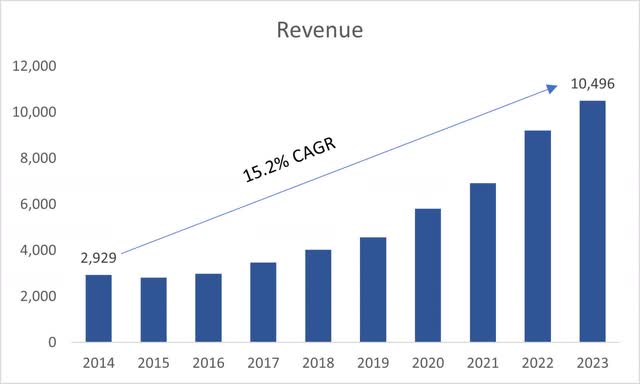

In terms of revenues, the company exhibited a very respectable growth over the last decade, however, the analysts are estimating the company will lose around 9% in FY24 and recover the next year. The analysts’ predictions change a lot over time as more and more info comes from the company, so I would expect these to change over time and I won’t be taking estimates that are out more than a year too seriously.

Revenue Growth (Author)

The company’s margins saw a slight deterioration in the past year, which makes sense. Negative sentiment towards the semiconductor industry was prevailing all year and these companies got pummeled. I’m sure the margins will either at least stay where they are or improve slightly over time as the cyclicality turns positive. KLAC has some impressive margins nonetheless, even with a slight decline.

Margins (Author)

Overall, the company looks to be performing just as well as any other semiconductor company I’ve covered in the past. Plenty of cash to weather any sort of storm and manageable debt levels that are coming down. An efficient and profitable company that has a competitive advantage and a strong moat in the industry that tops the competition. I don’t see any red flags in the financial health of the company.

Valuation

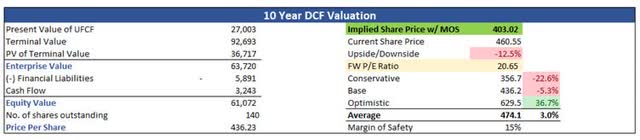

For revenue assumptions, I will anchor my base case to the analysts’ assumptions for FY24 only, which decreases revenue by around 9% from FY23 numbers. This will give me an extra margin of safety as I like to be on the conservative side of things. For the rest of the periods, I assumed the company would bounce back once the sentiment turned positive and everyone started loving the semiconductor industry, therefore, I went with around 8% CAGR from FY25 to FY33. If we include the 8% decrease in FY24, the CAGR ends up being around 7% from FY23 to FY33, which is quite more conservative than the previous decade’s growth rate.

For the optimistic case, I went with around 11% CAGR, while for the conservative case, I went with around 5% CAGR to give myself a range of possible outcomes. I believe these are on the lower end of estimates because I like to be more conservative and have a higher margin of safety that will result in better returns in the end.

In terms of margins, I decided to improve gross margins by around 120bps or 1.2% from FY23 numbers and operating margins by around 100bps. I believe the company will be able to achieve these margins over time as advancements in technology will introduce further efficiencies.

In terms of margin of safety, I decided to add an extra 15% MoS on top of these estimates to be extra cautious and to get a better bang for my buck. With that said, KLAC’s intrinsic value is around $400 a share, implying that the company is currently trading for a premium to its fair value.

Intrinsic Value (Author)

Closing comments

As an investor who has no position in KLAC, I would prefer to buy it at around $400. I feel that at that price, the company represents a decent risk/reward outcome and I wouldn’t be opposed to opening a small position at those prices and averaging down if it falls further because of some factors that do not come from how the company’s operating and more from external factors, because if the company is operating at such a level and nothing changes, then the external factors are just going to be noise and may represent a good entry point for accumulating a position for the long haul.

The company is a great addition for the long-term investor and since it is not very far from my PT, I would be looking into selling cash-secured puts at an Oct20 400 strike price if your pockets are deep enough to buy 100 shares once the option is exercised. This right now would net you around $300 a contract in premium (as of writing this article, KLAC is down 4%) because of implied volatility going up, which would bring your cost basis to around $397 a share. That is, if you’re happy owning the company at $400 a share.

Read the full article here